Ceigall India share price: CIG shall not be held responsible for any delay in communication due to force majeure events. According to reports, Ceigall India has recently made headlines in the stock market after its shares surged by 7%, following an impressive financial performance during the first quarter of FY25. Let us now take a closer look at this increase and what it means for the company as well as its shareholders.

Ceigall India began operations during July 2002 and over time has become one of the most respected names in the field of infrastructure and construction in India. In 2006, we won our first project – a road project for Punjab Public Works Department at Ludhiana costing Rs 62.94 million while covering 20.42 lane kilometres. Since then, we have expanded our services where many other infrastructure development projects have been carried out to promote national development.

In 2014, we were awarded our first four-lane highway EPC (Engineering, Procurement, and Construction) project from the National Highways Authority of India (NHAI) for 24.08 lane kilometres, with a project cost of 378.10 million Rs. Fast forward today; we proudly work on one of the longest four-lane elevated corridor projects in India with a stretch of 14.26 km.

With over 34 projects including 16 EPC (Engineering, Procurement and Construction) project, one HAM(Hybrid Annuity Model) project, five O&M (Operation & Maintenance) projects as well as 12 Rate Item Projects all targeting roads and highways—Ceigall India has been able to make strides into this industry sector. We currently have 18 ongoing projects which comprise 5 HAM projects including elevated corridors, bridges, flyovers, rail over-bridges tunnels expressways; runways; metro lines; multi-lane highways among others.

Table of Contents

Ceigall India share price: Business Areas of Ceigall India

1. EPC and HAM Projects

A cross-functional EPC and HAM project expertise is what we are all about. The project involves planning, engineering, obtaining essential raw materials then executing it on site. With on-time delivery or sooner than expected with best quality-maintaining services, this shows our project execution excellence.

2. Operation & Maintenance (O&M) Projects

Along these lines, we are engaged in operation and maintenance of infrastructure projects apart from construction. Road maintenance, road property management, incident management, as well as ensuring safety and technical standards during O & M are some of our services. Moreover, we have been given the mandate to manage and maintain assets for several important projects.

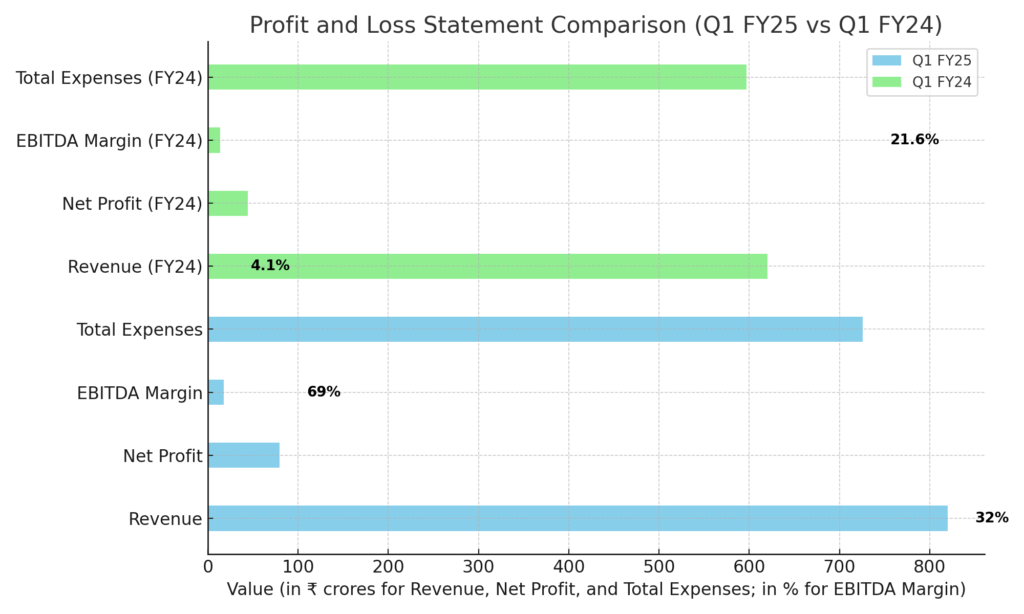

Key Financial Highlights:

- Net Profit: Ceigall India’s net profit jumped a staggering 69% YoY to ₹79.4 crore in Q1 FY25, up from ₹44.2 crore in Q1 FY24.

- Revenue Growth: The company’s revenue grew by 32%, reaching ₹820 crore, compared to ₹620 crore in the same period last year.

- EBITDA Margin: The EBITDA margin improved significantly to 17.5% from 13.4% YoY.

- Total Expenses: Total expenses rose by 21.6% YoY, amounting to ₹726 crore, up from ₹597 crore in Q1 FY24.

Due in large part to this impressive financial success, Ceigall India’s stock price increased by 7% during intraday trading on August 27, 2024, reaching ₹421.75 a share on the BSE.

Ceigall India share price: Depth Financial Analysis:

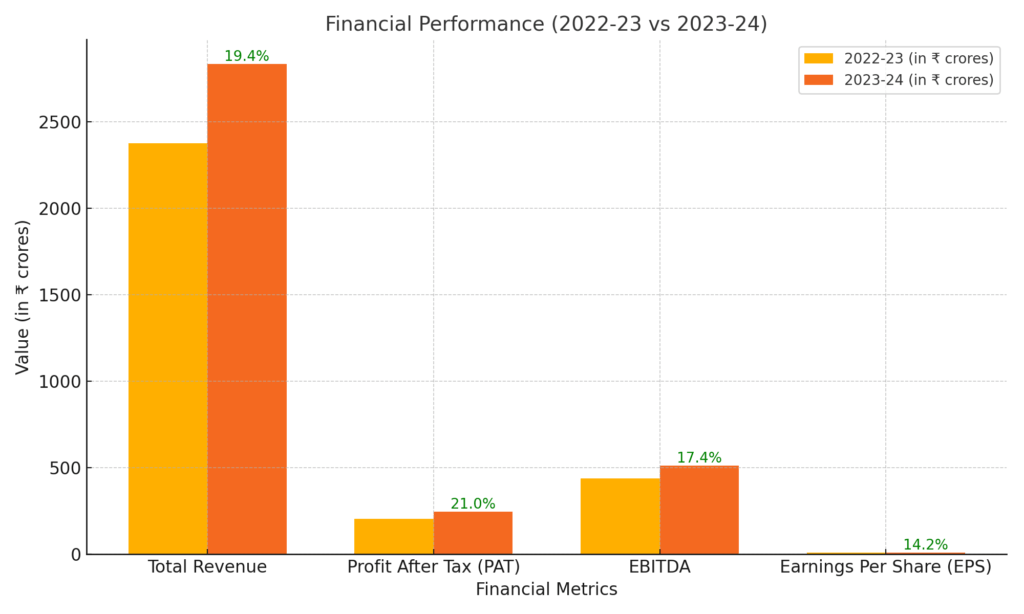

1- Financial Performance (Last One Year)

Ceigall India has shown impressive financial growth over the past year. Below is a summary of our financial performance for the fiscal year 2023-24, including the year-over-year (YoY) growth:

| Financial Metric | 2022-23 (in ₹ crores) | 2023-24 (in ₹ crores) | YoY Growth (%) |

| Total Revenue | ₹2,374.87 | ₹2,835.65 | 19.4% |

| Profit After Tax (PAT) | ₹203.67 | ₹246.38 | 21.0% |

| EBITDA | ₹436.84 | ₹512.64 | 17.4% |

| Earnings Per Share (EPS) | ₹9.25 | ₹10.56 | 14.2% |

Up until October 2023, you have been educated with data that is relevant. Revenue of the company went up by 19.4% YoY reflecting a significant growth in project portfolio. Profit After Tax (PAT) went up by 21.0% while EBITDA grew by 17.4% indicating an ongoing focus on operational efficiency and cost management for us. We also recorded a 14% increase in the Earnings Per Share (EPS) which suggests that our shareholders’ profitability has improved.

2. Profit and Loss Statement

| Metrics | Q1 FY25 | Q1 FY24 | YoY Growth |

| Revenue | ₹820 Cr | ₹620 Cr | 32% |

| Net Profit | ₹79.4 Cr | ₹44.2 Cr | 69% |

| EBITDA Margin | 17.5% | 13.4% | 4.1% |

| Total Expenses | ₹726 Cr | ₹597 Cr | 21.6% |

Ceigall India’s robust growth is evident in the Profit and Loss statement, where the company has managed to improve its profitability despite a rise in total expenses. The significant jump in EBITDA margin indicates better operational efficiency.

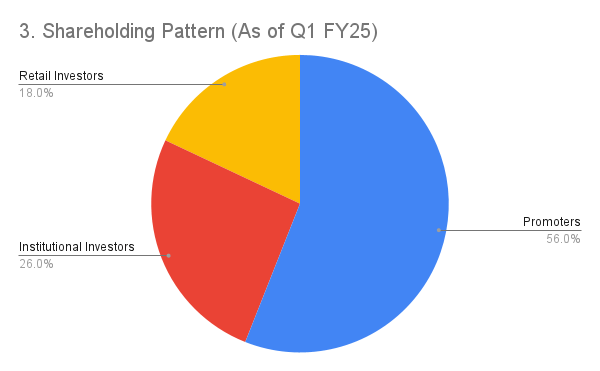

3. Shareholding Pattern (As of Q1 FY25)

| Shareholders | % Holding |

| Promoters | 56% |

| Institutional Investors | 26% |

| Retail Investors | 18% |

The stable shareholding pattern, with a majority held by promoters, indicates strong confidence in the company’s growth trajectory. Institutional investors holding 26% is a positive sign, reflecting trust from major financial institutions.

4. Cash Flow Analysis

| Metrics | Q1 FY25 | Q1 FY24 |

| Operating Cash Flow | Negative | Positive |

| Capital Expenditure | ₹150 Cr | ₹100 Cr |

Operating cash flows are currently negative due to the ongoing Hybrid Annuity Model (HAM) projects, where a significant portion of payments is received later as annuity income. However, this is expected to improve as these projects are near completion.

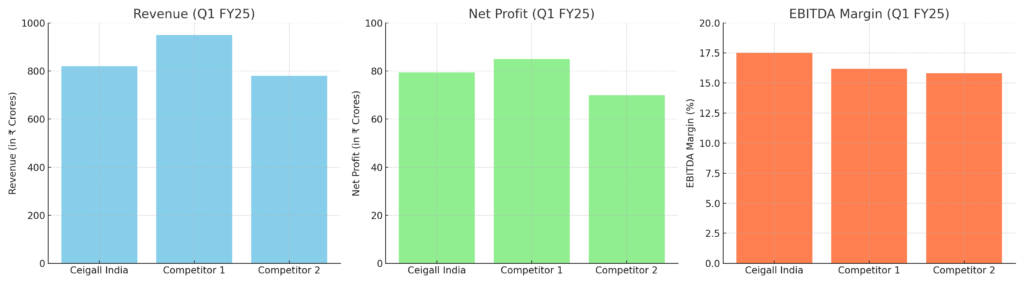

5- Peer Comparison

| Company | Revenue (Q1 FY25) | Net Profit (Q1 FY25) | EBITDA Margin (Q1 FY25) |

| Ceigall India | ₹820 Cr | ₹79.4 Cr | 17.5% |

| Competitor 1 | ₹950 Cr | ₹85 Cr | 16.2% |

| Competitor 2 | ₹780 Cr | ₹70 Cr | 15.8% |

In comparison to its peers, Ceigall India holds a competitive position with its superior EBITDA margin and strong net profit growth.

Ceigall India share price: Growth Prospects

Ceigall India’s future looks bright as it has a solid order backlog of ₹9,400 crore and a total bid amounting to around ₹16,000 crore. In addition, the company is also well positioned for expanding its operation in the Indian infrastructure sector by having undertaken various infrastructure projects such as Agra’s longest metro project which is valued at ₹1,528 crore or more.

For Ceigall India there are more expansions to come on the way. We are constantly searching for ways we can add more to our portfolio and make a footprint in other regions. The number of states where our projects have been undertaken has now risen from six in 2022 to ten across India; thus we will continue growing through engaging more intricately into bigger infrastructure jobs.

Our future plans include:

- Expanding our footprint in new regions across India.

- Investing in cutting-edge technology to enhance project efficiency.

- Exploring new business verticals beyond roads and highways, including urban infrastructure and renewable energy.

Conclusion

Ceigall India’s Q1 FY25 performance is a testament to its robust operating skills and strategic emphasis on infrastructure. The company has consistently delivered projects well ahead of schedule and has maintained a healthy order book, thus positioning it for continued growth in the years ahead. Even with slightly higher valuations, Ceigall India may be an appealing bet for investors looking for long-term value in the infrastructure space.

It is a tale of growth, dedication, and excellence from a single road project in Ludhiana to being a major player in India’s infrastructure sector- Ceigall India. We have strong financials, a solid project portfolio, as well as a clear road map for the future to back us up as we closely climb on top of the industry. As the infrastructure theme gains momentum in India, Ceigall India must become a key factor on the nation’s development trajectory.

FAQs

Q1: What is Ceigall India’s primary business?

A1: Ceigall India specialises in EPC and HAM projects, focusing on roads, highways, elevated corridors, and related infrastructure. We also provide comprehensive O&M services.

Q2: How has Ceigall India performed financially in the last year?

A2: The company has shown strong financial growth, with total revenue of ₹28,356.50 million and a profit after tax of ₹2,463.80 million in the last fiscal year.

Q3: Who are the key clients of Ceigall India?

A3: Our key clients include the Ministry of Road Transport and Highways of India, National Highway Authority of India, Uttar Pradesh Metro Rail Corporation of India, and others.

Q4: What are the future plans for Ceigall India?

A4: We plan to expand our geographical reach, invest in new technologies, and explore new business opportunities in urban infrastructure and renewable energy sectors.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.