Q2 Results Day: There might be considerable movement in the stock market as a number of companies will be announcing their quarterly earnings, important corporate news, and announcements that will affect the market. Whether it is Titan’s impressive numbers from the jewellery vertical or Jio Financial’s getting the go ahead by SEBI, there’s enough entertainment for the investors and the analysts alike. In this write-up, our focus to the most important news, financial numbers and forecasts regarding Bandhan Bank, GAIL, Lupin and the last but not least others.

Titan Company Q2 Results: Strong Growth Across Segments

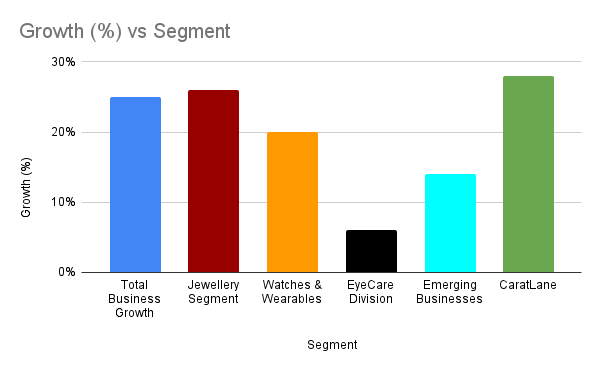

One of the key performers on October 7 will be Titan Company, which posted robust year-on-year (YoY) growth in multiple segments. Here’s a breakdown of their Q2 performance:

| Segment | Growth (%) |

| Total Business Growth | 25% |

| Jewellery Segment | 26% |

| Watches & Wearables | 20% |

| EyeCare Division | 6% |

| Emerging Businesses | 14% |

| CaratLane | 28% |

Titan’s overall growth of 25% is impressive but it can be attributed primarily to the jewellery division, which grew by 26%. To not be ignored, the watches and wearables segment registered an impressive growth of 20%. Moreover, the EyeCare division of Titan and new businesses showed commendable performance as well. Interestingly, CaratLane grew by a whooping 28%, showing strong presence in the online jewellery market.

Why This Matters:

Titan’s performance could be a sign of increasing consumer spending, especially in high-value segments like jewellery and wearables. Investors should watch how Titan leverages its growing brand value across these segments for future growth.

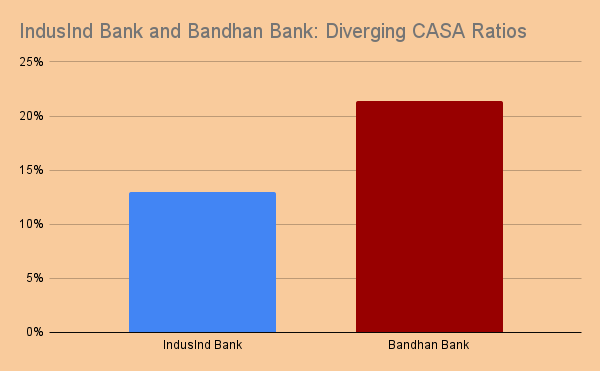

IndusInd Bank and Bandhan Bank: Diverging CASA Ratios

Banks like IndusInd Bank and Bandhan Bank will also be in focus. Here’s how their Q2 numbers stack up:

| Bank | YoY Growth in Advances (%) | CASA Ratio (%) |

| IndusInd Bank | 13% | 35.9% (decline) |

| Bandhan Bank | 21.4% | 33.2% (decline) |

IndusInd Bank saw its net advances grow by 13% YoY to ₹3.57 lakh crore, with deposits up by 15%. However, their CASA ratio—an important metric for bank profitability—declined to 35.9% from 39.4%.

Similarly, Bandhan Bank experienced a more substantial 21.4% rise in loans and advances, but its CASA ratio also declined to 33.2%. This decline in CASA ratios could signal challenges in attracting low-cost deposits, which might affect profitability in the coming quarters.

Should You Be Worried About the Decline in CASA Ratios?

The drop in CASA ratios across multiple banks, including IndusInd and Bandhan, might be worth monitoring. Declining CASA ratios could lead to higher borrowing costs for banks, impacting margins. However, the strong advances growth indicates that demand for loans is still robust.

Table: Declining CASA Ratios Across Key Banks

| Bank | Previous CASA Ratio (%) | Current CASA Ratio (%) |

| IndusInd Bank | 39.4% | 35.9% |

| Bandhan Bank | 38.5% | 33.2% |

| Federal Bank | 31.17% | 30.07% |

| RBL Bank | 35.7% | 33.5% |

GAIL and Jio Financial Services: Corporate Moves to Watch

Two significant corporate events will unfold on the 7th of October in connection with GAIL (India) and Jio Financial Services. In an announcement that changes the course of events in the sprawling empire of Jio, Jio Financial Services has received an in-principle nod from the regulator SEBI to enter into mutual funds business along with the BlackRock Financial Management.

With the integration of the two, it’s easy to tell that this could give the competitors run in the mutual fund segment. GAIL (India) has reverted back its attention to renewable energy and, hence, signed a new MoU with AM Green to develop up to 2.5 GW of renewable energy projects. Besides, the alliance will look into green energy hybrid and eMethanol manufacturing projects as well.

Is This the Start of a New Energy Revolution for GAIL?

For GAIL, shifting towards green energy is in harmony with the strategies of other companies which are expanding their energy portfolio by including renewables. It would be interesting to see as to how this partnership develops over the years, especially because sustainable energy has increasingly become vital in the corporate strategies.

Poonawalla Fincorp: Asset Growth and Liquidity

Poonawalla Fincorp has reported significant growth, with assets under management (AUM) growing by 40% YoY to ₹28,350 crore. Additionally, the company’s liquidity stands at ₹5,700 crore.

Why This Growth Matters:

Poonawalla Fincorp’s strong liquidity position and 40% AUM growth make it a strong candidate for further expansion. Given its strong focus on consumer and MSME lending, the company is well-positioned to capture more market share in the financial sector.

Lupin Under US FDA Scrutiny

News has its good and bad sides. It is reported that Lupin has encountered five observations given by the US FDA after the inspection of the Pune based biotechnology site. Although the specifics of the inspection results are unavailable in the public domain, such regulatory actions may cause interruptions in business operations and risks of penalties.

What Should Investors Do?

For Lupin investors, it’s crucial to monitor any updates regarding the FDA observations. Depending on the severity, it could lead to a decline in stock price, as regulatory issues often impact investor confidence.

Other Key Stocks to Watch on October 7

- Antony Waste Handling Cell: Their subsidiary AG Enviro Infra Projects secured a ₹908 crore contract for solid waste management, indicating strong revenue potential for the next nine years.

- Paytm (One 97 Communications): Paytm has made significant management changes, with the transition of Manmeet Singh Dhody to AI Fellow and the appointment of Deependra Singh Rathore as the new CTO. This signals Paytm’s focus on strengthening its technology backbone, which is crucial for future growth.

- Federal Bank: Advances grew by 19.3%, with deposits up by 15.6%. However, similar to other banks, their CASA ratio moderated to 30.07%.

Conclusion: What to Expect on October 7

The market is poised for a busy day on October 7, with companies across sectors making big moves. From Titan’s impressive Q2 performance to regulatory challenges faced by Lupin, and the strategic moves by Jio Financial and GAIL, investors have plenty to keep an eye on.

While the banking sector may see some pressure due to declining CASA ratios, robust growth in advances and deposits indicates that the financial ecosystem remains strong. Additionally, companies like Poonawalla Fincorp and Antony Waste Handling Cell could offer long-term value based on their recent developments.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.