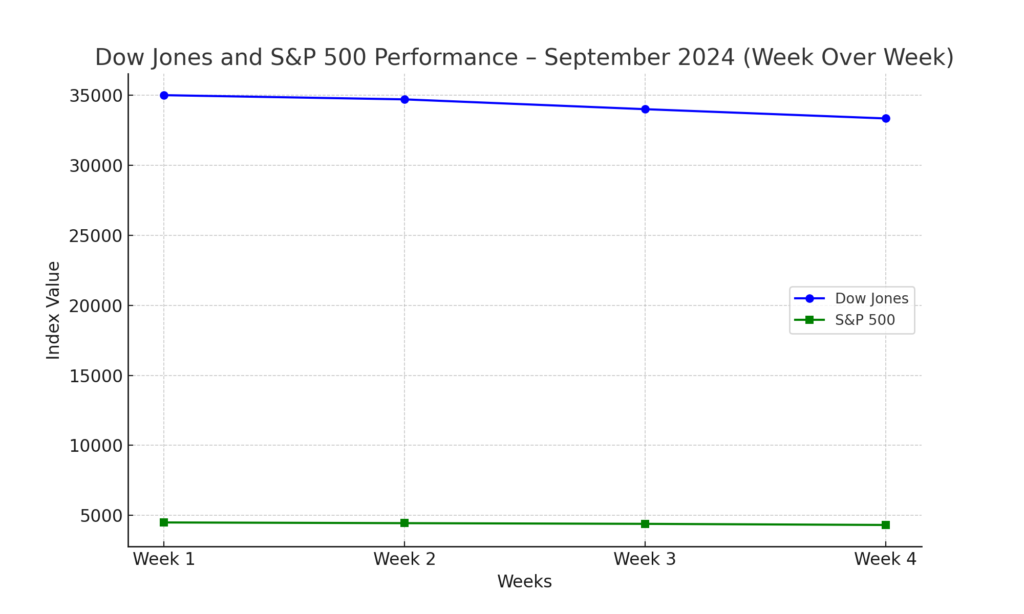

Stock Market Volatility: Stock Exchange witnessed ups and downs during September 2024 with notable volatility and DOW JONES INDUSTRIAL AVERAGE (DJIA) plummeting by 600 points on a single trading day .Such market reaction is attributed to various factors like inflation data ,expectations concerning Federal Reserve policy and outside global economic influences .This blog post aims at discussing the major causes of such market fluctuations; examining the role of inflation in determining investor expectations as well as predicting some possible outcomes for next Federal Reserve meeting .We will also consider the implications of these trends for ordinary investors and how to cope with the stormy sea.

Stock Market Volatility: Why Did the Dow Drop Over 600 Points?

On Wednesday, the headline of stock market chaos was the loss of 661 points in the Dow Jones Industrial Average, representing a drop of 1.6%. The broad-market S&P 500 index followed suit, losing 1.2%, while the technology-laden Nasdaq Composite experienced a more modest decline of 0.7%.

Key Factors Leading the Dow’s Decline:

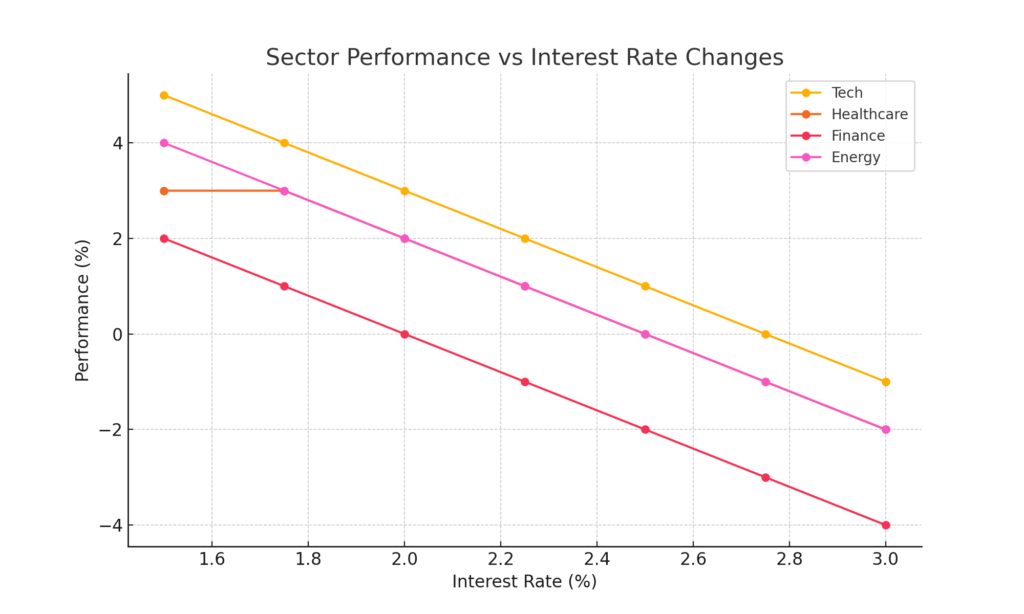

- Sector Underperformance: The majority of the companies that form DJIA, such as UnitedHealth Group, Goldman Sachs and Amgen were responsible for bringing down the entire index. Stocks in healthcare and financial services were particularly affected, reflecting both wider economic anxieties and risks specific to a particular sector.

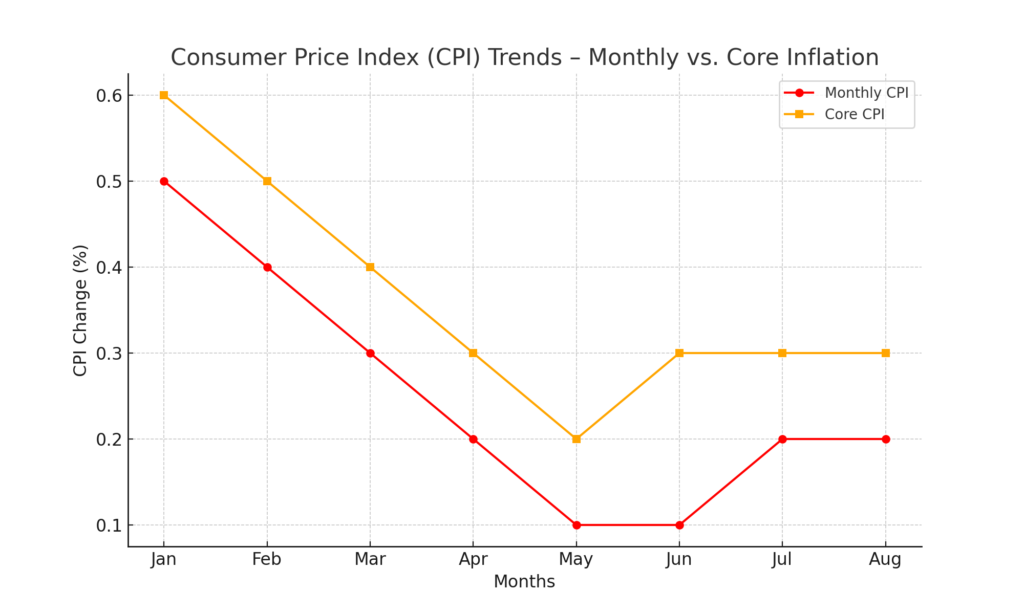

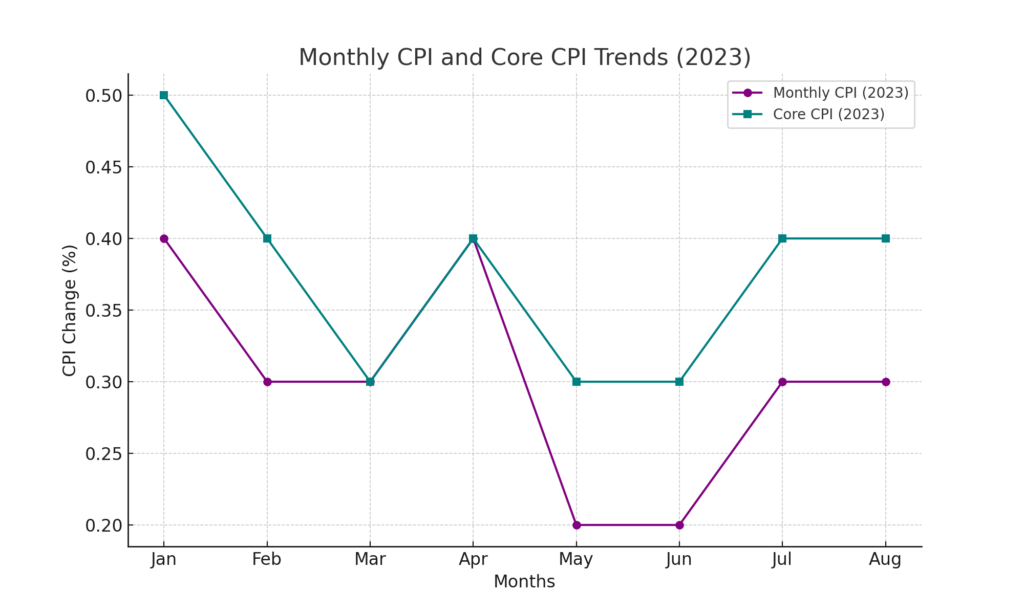

- Inflation Data Impact: The latest Consumer Price Index (CPI) report, which came out recently, caused a major market decline. In August, CPI increased by 0.2%, making annual inflation at 2.5%, the lowest since February 2021. This was slightly better than what most people had been expecting, which was 2.6%. However core inflation (which excludes volatile food and energy prices) rose 0.3%, surpassing expectations of 0.2%. Thus, this higher than expected core inflation possibly heightened worries about continuous rising prices.

- Interest Rate Expectations: Investors are focused on the Federal Reserve’s meeting in September where it is expected that there will be a widely awaited interest rate cut of 25 basis points. As per CME Group’s FedWatch tool, currently traders have priced in an 85% chance that the Fed will approve this reduction. In days to come, market trends will be influenced by interest rates resolved by the central bank.

Sector Performance Snapshot

| Sector | Recent Performance | Outlook |

| Healthcare | Declined | Defensive |

| Tech | Mixed | Growth potential |

| Energy | Declined | Volatile due to inflation |

| Financials | Declined | Rate sensitive |

Is Inflation a Good or Bad Sign for Markets?

A major influence on the stock exchange as well as on the economy at large is inflation. The report released in August concerning inflation for instance indicates that there was a 0.2% rise in CPI monthly which can be seen as evidence of its cooling nature although core inflation exceeded expectations.

What Does the Latest Inflation Data Mean?

- Headline CPI: A 0.2% increase for the month signifies a slowdown in inflation. This trend is generally favourable to consumers and businesses alike because it eliminates cost pressures and increases consumer purchasing power.

- Core CPI: More than anticipated, the core inflation measure (which excludes food and energy) has risen on account of rising costs for housing and services. Thus, this indicates that even though energy prices have gone down, there are still inflationary pressures that may provoke continuous fears about price stability.

How Has Inflation Affected Federal Reserve Policy?

The Federal Reserve is determined to keep the price level under control and also support job creation. As the cost of living returns to normal levels, there is less justification for keeping interest rates high. However, the unexpectedly increased core inflation rate might make it necessary for the Fed to be cautious in future policy decisions.

The Difficulty of Reducing Rates:

Since traders have placed an 85% chance on a 25 basis point reduction at the next meeting of the central bank, expectations regarding inflation data are at the core of such thinking. Should this trend in lower prices continue, they may lower rates in which case stock markets tend to benefit as borrowing becomes less expensive hence encouraging investments by companies.

How will this affect the markets?

- Lower interest rates generally increase equity prices because credit becomes cheaper, stimulating profitability among firms and enhancing consumer spending power.

- However, if inflation remains stubbornly high, it could limit the Fed’s ability to reduce rates further and thereby slow future market growth.

Seasonal Trends: Why is September Such a Volatile Month?

Derivations of S&P index over ten years show that September has been a bad month for the stock market. Loose, it has lost about one percent every year in this month- during the last four years. Hence observed on average to lose approximately a loss of more than one percent at S&P 500 every September.

Seasonal Headwinds Affecting Market Behaviour:

- Tax-Loss Harvesting: Investors often sell off losing stocks in September to offset capital gains elsewhere, contributing to downward pressure on the market.

- Macroeconomic Events: September is often a busy month for central bank meetings, economic data releases, and corporate earnings reports, creating heightened uncertainty.

Historical Performance Table:

| Month | Average S&P 500 Performance (Last 10 Years) | Number of Negative Years (Last 10 Years) |

| January | +0.5% | 4 |

| February | -0.7% | 5 |

| March | +1.2% | 3 |

| April | +1.5% | 2 |

| May | +0.3% | 4 |

| June | +0.1% | 5 |

| July | +1.8% | 2 |

| August | -0.4% | 6 |

| September | -1.2% | 7 |

| October | +0.6% | 5 |

Market Outlook: What Can Investors Expect Moving Forward?

Is the Federal Reserve Likely to Cut Rates?

Informed by the existing inflation numbers and prevailing market phenomena, a lot of analysts notably including Scott Helfstein, Global X head of investment strategy predict that in its forthcoming policy meeting; the Federal Reserve will reduce rates by as much as 25 basis points.

Helfstein argues that it would be wise to stabilise prices through a rate cut in order to enhance corporate performance thereby paving the way for stronger markets in the near future. According to him it is not only about central bank policies but also macroeconomic fundamentals that drive today’s economy.

Could Inflation Rebound?

Inflation is slowing down but core inflation is still sticking on a high figure. Investors need to be careful because if the inflation remains as it is the Federal Reserve may not lower interest rates as they had decided or even do the reverse if inflation happens to rise unexpectedly. Therefore, observing how this board acts in the forthcoming week is very important thing it must do.

Impact of Cryptocurrency and Global Events

While inflation and interest rate news continue to catch people’s minds in the stock market, cryptocurrencies have been suffering from their own unique problems. The price of bitcoin has decreased a little; likewise, coinbase and MicroStrategy stock prices dropped as crypto traders are trying to understand the policies of central banks especially when it comes to Japan.

Again, raising interest rates by the Bank of Japan creates more ambiguity globally affecting stock and crypto markets. The performance of bitcoin is also influenced by some other macroeconomic events like US elections and inflation statistics.

Bitcoin Performance and Investor Sentiment:

- Bitcoin Market Movements: Down 1% in early September due to mixed reactions to inflation and central bank policy changes.

- Impact on Key Companies: Companies like Coinbase (down 2%) and Marathon Digital (down 3%) have felt the pressure from bitcoin’s price fluctuations.

Conclusion: Navigating September Volatility and Inflation Concerns

Investors are having a tough September as stock market fluctuations stem from poor performance of sectors, inflation worries, and a Federal Reserve rate cut expectations. Core inflation remains above projections despite significant deceleration in inflation, which raises questions about future policies by The Fed. Hence investors should prepare themselves for further turmoil as they seek to understand this economic language.

What Should Investors Do Now?

- Diversify: Focus on building a diversified portfolio to hedge against sector-specific risks.

- Monitor Federal Reserve Actions: Stay alert for updates from the Fed’s September meeting, as interest rate decisions will heavily influence market direction.

- Prepare for Volatility: Understand that September tends to be a volatile month, and market swings are not uncommon.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.