Bharti Airtel Share Price: Bharti Airtel is preparing to buy AXA’s 49% holding in Bharti AXA Life Insurance in a landmark move in the insurance business, marking a big leap for both firms.

This strategic acquisition will see Bharti Airtel’s subsidiary, Bharti Life Ventures Private Limited (BLVPL), with full control of Bharti AXA Life Insurance.

Table of Contents

Bharti Airtel Share Price: Group’s Agreement with AXA

Bharti Group made an announcement on Wednesday regarding its agreement with joint venture partner, AXA, to acquire 49% investment in Bharti AXA Life Insurance. This move features Bharti Airtel’s devotion to the life coverage industry, with a specific spotlight on the Indian market.

BLVPL Takes the Helm

Bharti Life Ventures Private Limited (BLVPL), the holding company of Bharti AXA Life Insurance, will now own 100% of the stake in the life insurer following this deal. This acquisition will reshape the landscape of the life insurance industry in India.

Bharti Airtel Share Price: AXA’s Exit and the Road to Ownership

AXA, a major French insurance company, presently owns 49% of the joint venture with Bharti.Following the merger of Bharti AXA General Insurance with ICICI Lombard in 2020 and AXA’s subsequent exit from ICICI Lombard’s shareholding, BLVPL has now agreed to buy AXA’s 49% stake in the firm and become its sole owner.

Expanding Strategic and Financial Partnerships

Bharti Airtel’s objective with this acquisition is to ensure the continued service of the Indian life insurance market. Additionally, the company is actively engaging with other strategic and financial investors to further scale this business.

Expected Completion in December 2023

The purchase is planned for completion in December 2023, pending regulatory approvals. This improvement means another time in the life coverage industry in India, and Bharti Airtel is ready to lead the way.

Bharti Airtel Share Price: Competitive Market Jio-Airtel Battle for Home Wi-Fi Connections

Bharti Airtel is making waves in the insurance business while simultaneously battling with Reliance Jio to increase revenue per user (Arpu) through packaged offerings.The telecom titans are experimenting with a number of techniques to optimise the value of their commodities in order to boost income, leaving no option unexplored.

The Significance of Arpu

Average revenue per user (Arpu) is a crucial measure in the telecom industry that acts as an assessment of a company’s financial performance. Both Jio and Airtel are significantly investing in 5G networks, increasing network capacity and reach.

The Path to Monetization

Telecom companies like Jio and Airtel are seeking for new methods to monetise their 5G infrastructure expenditures.

The home broadband market, with its high consumption and (Arpu) potential, has become a lucrative focus area, especially with the enhanced capacity since the 5G launch.

Airtel’s Competitive (Arpu) Figures

Airtel’s mobile (Arpu) at the end of the first quarter of FY24 was Rs 200, while its (Arpu) for home services reached an impressive Rs 608. These numbers showcase the company’s competitive edge in the market.

Jio’s Growth and Arpu

On the other hand, Jio’s overall (Arpu) for the first quarter of FY24 stood at Rs 180.5, indicating a nearly three percent increase from the previous year. The rise in (Arpu) is credited to Jio’s fibre to the home (FTTH) services, though specific FTTH (Arpu) figures were not released.

A Lucrative Opportunity

Experts in the industry agree that the home broadband segment offers significant growth potential, with many homes still lacking a wired broadband connection. Fixed wireless access (FWA) is seen as a solution to reach customers in areas where fiber infrastructure cannot reach directly.

Expanding Market Reach

Jio has ambitious plans to expand its market to connect 200 million homes in the next three years with the launch of its FWA services. This expansion is set to reshape the home services market.

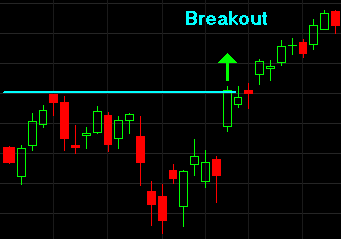

Stocks at Multi-Year Highs: Bharti Airtel Share Price Among Top Performers

Bharti Airtel is generating waves in the stock market in a distinct market area.It recently reached a multi-year high, signifying the company’s strong performance and investor confidence.

Bharti Airtel Share Price: The Conclusion

The acquisition of AXA’s interest in Bharti AXA Life Insurance by Bharti Airtel demonstrates the company’s commitment to the Indian insurance business.

As it battles with other telecom giants like Reliance Jio to increase (Arpu) through home services, Bharti Airtel continues to be a significant player in both the insurance and telecom industries. Bharti Airtel is positioned itself for a successful future with these smart actions and high-performing equities.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.