Arkade Developers IPO: In India’s Mumbai Arkade Developers, is one of the most prominent real estate firms with over three decades of experience in the sector. The company was founded by Mangilal Jain and Amit Jain who have made a name for themselves for delivering quality residential and commercial properties. Its core values are Trust, Quality, Ethics and Transparency which are the pillars of its success within the real estate industry.

1- Company Overview

Team leadership

The leadership team at this company comprises exceptionally qualified personnel:

Amit Jain: He graduated in science from the Mumbai University; he plays a pivotal role in driving Arcade’s vision as well as executing innovative ideas on its several projects.

Arpit Jain: He is a Chartered Accountant who handles finance and marketing for the organisation thereby greatly contributing to business expansion.

Neha S. Huddar: This is an Independent Director with strong financial background; she has functioned formerly as the Chief Financial Officer (CFO) of Thirumalai Chemicals.

Hiren Tanna: Another Independent Director provides structural engineering expertise to the organisation.

Abhishek Dev: An Independent Director with a lot of experience in finance and asset management.

Project and Visions

Arkade developers are mostly focused on new constructions as well as redevelopment projects mainly in the western suburbs of Mumbai. The company has so far undertaken construction totaling over 4.5 million square feet; this serves to show their commitment towards future growth as evident with active and ongoing projects they have at hand. All forms of developments done by Arkade prioritise “REST Advantage” philosophy that entails rejuvenation, eco-friendliness, sustainability and technology.

Different Business Segments

Arkade Developers operates primarily in two segments:

New Residential Buildings Development: This comprises building residential properties on newly purchased land

Redevelopment projects: The firm is also involved in redeveloping pre-existing structures especially within densely populated zones found throughout Mumbai.

From 2017 until Q1 2024, the company introduced 1,220 housing units selling 1,045 of them in separate markets within the Mumbai Metropolitan Region (MMR). As at June 30 2024; Arkad Developers had completed 2.20 million square feet of residential property development.Apart from these residential units that were launched between 2017 to Q1 2024; Arkade Developers’ achievement also includes 2 lakh square feet built-up area spread over eleven separate redevelopment schemes executed since year 2003 including single scheme at south central mumbai through a partnership covering more than one million sq ft. Which is about forty acres worth of land?

History and WorkForce

In the last two decades, Arkade has done a total of 28 projects. This comprises 11 independent projects, 2 done by majority held partnership companies and 9 through joint development contracts with other parties. All these amount to over 4.5 million sq. ft., which serve more than 4000 happy clients.

By June 30, 2024, 201 permanent employees will be working at the company, while 850 other workers will have been employed on contract basis to bolster its workforce in order to meet all present and future aspirations.

With this strategy in mind, Arkade Developers continues to maintain its position as one of Mumbai’s leading real estate developers through innovation, customer orientation and a proven record of accomplishments in project delivery.

2- Arkade Developers IPO Importance

Arkade Developers is raising ₹410 crore through its IPO in order to finance on-going projects, land acquisitions for the next future, and other corporate expenses. In doing this, the aim is to strengthen its presence in the competitive Mumbai real estate sector. The company has shown impressive financial growth, with a 189% increase in revenues to ₹635 crore, while net profits have doubled to ₹123 crore in FY24.

This company which operates from Mumbai, a high-demand real estate market has developed over 1.80 million square feet of residential space besides having an extensive pipeline of projects. The IPO price ranges between ₹121-128 per share hence indicating a potential gain of 49% according to positive sentiments on the market. The funds will be strategically allocated towards ongoing projects whose revenue potential is about ₹2,350 crore thus positioning Arkade for sustainable future growth making it an attractive opportunity for the investors.

3- Arkade Developers IPO key Details

- IPO Dates: September 16, 2024 to September 19, 2024

- Listing Date: Tuesday, September 24, 2024

- Face Value: ₹10 per share

- Price Band: ₹121 to ₹128 per share

- Lot Size: 110 shares

- Total Issue Size: 32,031,250 shares (aggregating up to ₹410 crore)

- Fresh Issue: 32,031,250 shares (aggregating up to ₹410 crore)

- Issue Type: Book Built Issue IPO

- Listing On: BSE and NSE

- Pre-Issue Shareholding: 153,626,016 shares

- Post-Issue Shareholding: 185,657,266 shares

4- Arkade Developers going public: Key reasons

Arkade Developers intends to raise ₹410 crore through its forthcoming IPO for the purpose of financing the company’s growth and expansion plans. The principal objectives of the IPO include:

Funding Ongoing and Upcoming Projects

A substantial portion of IPO proceeds will be directed towards financing development costs on Arkade’s current projects, which include Arkade Nest, Prachi CHSL and C-Unit.

With this capital, the enterprise will complete all these initiatives in addition to initiating new ones that are in the pipeline.

Acquisition of Future Land

The other part of these initial public offering funds may be used to purchase land for future real estate projects in Mumbai.

It is a measure meant to afford Arkade an opportunity to grow its land bank as well as project portfolio promoting long-term growth.

General Corporate Purposes

On the other hand, the remaining funds will be used for general corporate purposes aimed at ensuring sustained growth and expansion of the business.

This includes working capital requirements funding, debt repayments as well as other corporate expenses.

Through its IPO, Arkade Developers set out to improve financial position, expedite project execution, and gain from increasing demand for high-end residential properties within the Mumbai area by raising funds. The funds will assist the company in delivering quality projects as well as creating value for shareholders.

5- Arkade Developers IPO: Company Financials

Unbelievable Growth in Revenue

In FY24, Arkade Developers achieved remarkable performance by recording astonishing revenue of ₹635.71 crore which is a huge increase from ₹224.01 crore in FY23 with an impressive year-on-year increase of 183.84%. High surge demonstrates that the company is continuously expanding to new markets while there is rising demand for its projects.

Profit Explosion

In FY24, Arkade Developers did not only increase its revenue but also saw that it more than doubled its net profit. The profit increased from ₹50.77 crore in FY23 to ₹122.81 crore which is quite a big leap. This 142% rise reflects strong operational efficiency and effective cost management by Arkade further consolidating its position in the market.

Steady Financial Growth

Over the years, Arkade Developers has been on a steady growth trajectory. Revenue for instance can be traced back to FY23 as ₹224 crore, FY22 as ₹237 crore and FY21 as ₹113 crore respectively. Consistent upward movement shows the ability of this organisation to complete any challenges present at their time while improving their finances.

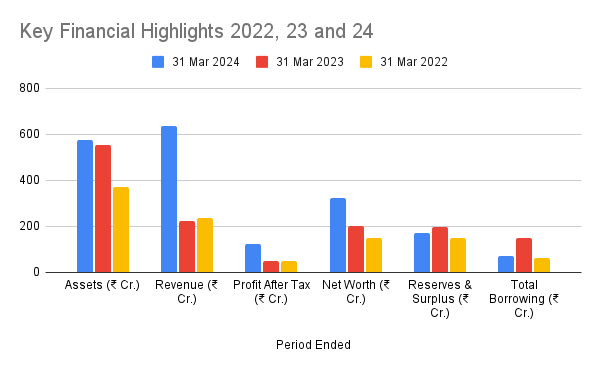

FY24 vs. FY23: Key Financial Highlights

- Revenue Growth: A massive 184% increase from ₹224.01 crore in FY23 to ₹635.71 crore in FY24.

- Profit After Tax (PAT): Jumped by 142%, from ₹50.77 crore in FY23 to ₹122.81 crore in FY24.

- Net Worth: Grew from ₹200.32 crore in FY23 to ₹323.4 crore in FY24.

- Total Assets: Increased from ₹555.41 crore in FY23 to ₹575.01 crore in FY24.

| Period Ended | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets (₹ Cr.) | 575.01 | 555.41 | 369.97 |

| Revenue (₹ Cr.) | 635.71 | 224.01 | 237.18 |

| Profit After Tax (₹ Cr.) | 122.81 | 50.77 | 50.84 |

| Net Worth (₹ Cr.) | 323.4 | 200.32 | 149.5 |

| Reserves & Surplus (₹ Cr.) | 171.4 | 198.32 | 147.49 |

| Total Borrowing (₹ Cr.) | 69.41 | 149 | 64.41 |

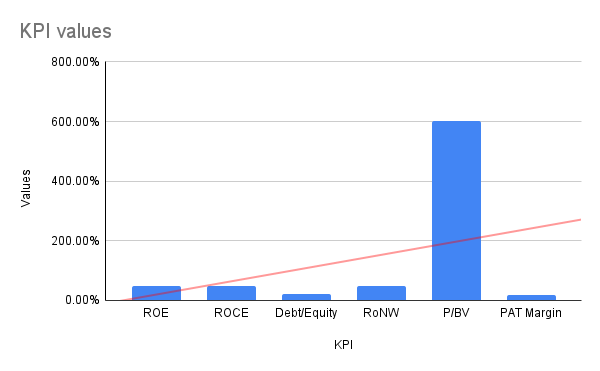

Strong Key Performance Indicators (KPIs)

Arkade Developers’ performance in FY24 is underscored by key financial metrics that highlight its operational efficiency and financial health:

- Return on Equity (ROE): 46.90%

- Return on Capital Employed (ROCE): 47.34%

- Debt to Equity Ratio: 0.21

- Return on Net Worth (RoNW): 46.90%

- Price to Book Value (P/BV): 6.02

- Profit After Tax Margin: 19.35%

With a market capitalization of ₹2,376.41 crore as of March 31, 2024, Arkade Developers stands strong among its peers, reflecting its solid financial standing.

| KPI | Values |

| ROE | 46.90% |

| ROCE | 47.34% |

| Debt/Equity | 0.21 |

| RoNW | 46.90% |

| P/BV | 6.02 |

| PAT Margin | 19.35% |

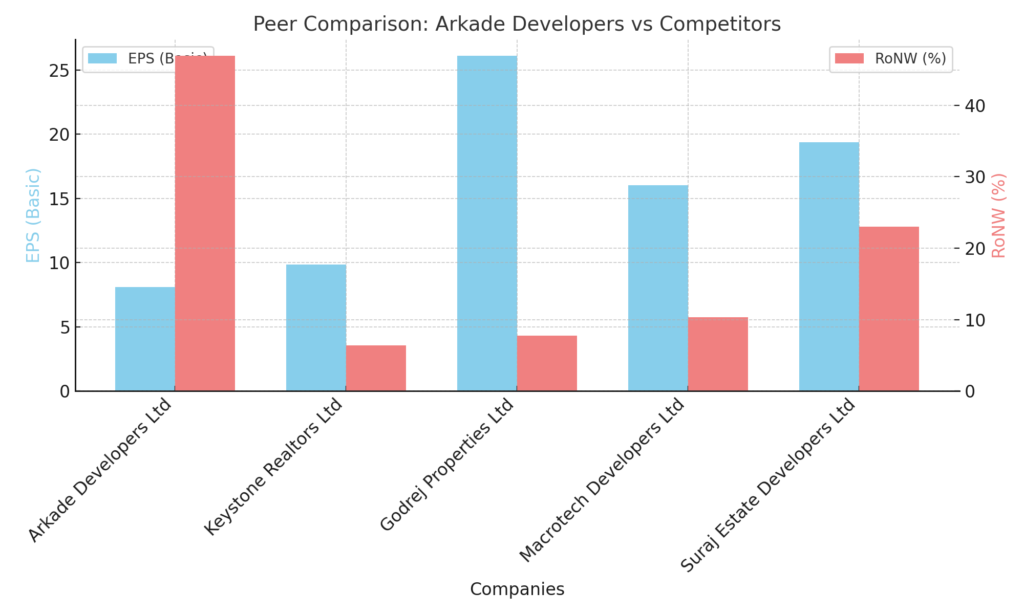

Arkade Developers IPO: Peer Comparison

The ever-evolving world of real estate witnessing stiff competition continues to showcase Arkade Developers as a force to reckon with financially. For instance, while EPS and NAV per share may not compare favourably with larger firms such as Godrej Properties or Macrotech Developers, Arkade demonstrates a remarkable RoNW of 46.9%, which is higher than what many competitors can manage.

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (₹) | P/E (x) | RoNW (%) |

| Arkade Developers Limited | 8.08 | 8.08 | 21.28 | N/A | 46.9 |

| Keystone Realtors Limited | 9.85 | 9.82 | 157.81 | 74.85 | 6.4 |

| Godrej Properties Ltd | 26.09 | 26.08 | 359.4 | 111.53 | 7.76 |

| Macrotech Developers Limited | 16.03 | 15.99 | 180.8 | 78.46 | 10.32 |

| Suraj Estate Developers Limited | 19.39 | 19.39 | 148.3 | 40.92 | 22.97 |

All financial data is based on the audited consolidated financial statements of the respective companies as of March 31, 2024

6- Strengths and Risk factors of Arkade Developers IPO

Arkade Developers possesses several strengths that position it favourably in the competitive Indian real estate market. Here are the key strengths:

Strengths

Strong Portfolio

Arkade Developers boasts a strong portfolio of both residential and commercial projects, with 27 completed projects covering more than 4 million square feet of development. Some of their flagship projects are:

- Arkade Nest

- Arkade Prime

- Arkade Crown

- Arkade Aspire

- Arkade Aura

Five ongoing projects and two more that will be added soon to the list are currently under construction by this company as they aim at achieving an extra 2 million square feet in total. The development of such varied estate gives an opportunity for Arkade to serve different market brackets ranging from high-end residential areas to middle-income households thereby widening its outreach as well as clientele base.

Experienced Management Team

Amit Jain, who is the visionary person focused on customer satisfaction, heads the management team that Arkade Developers has. Also, Amit Jain is backed up by Arpit Jain who is an expert in finance while Neha Huddar, Hiren Tanna and Abhishek Dev serve as independent directors bringing in knowledge from finance, engineering and asset management respectively ensuring use of development that is operationally excellent thus it will ensure growth within attached to such types of firms as it results to quality delivery of projects.

Strong Regional Presence

Arkade Developers is undoubtedly a well-established name in the Mumbai metropolitan region (MMR), mainly in its western and eastern suburbs. The company has made this strategic decision to focus on high-demand areas which enable it to tap a significant amount of the residential market with consistent strong sales performances. The company has established itself as an authority within the Mumbai real estate sector by delivering projects on time and ensuring quality construction.

In general, Arkade Developers’ robust project portfolio, experienced management team and strategic geographical focus give it a competitive edge in India’s property market.

Risk Factors

Volatility in the Real Estate Market

In a natural way, cycles of the real estate market are closely connected with changes in demand and prices. When there is an economic turmoil, people’s tastes change or demography shifts, sales can dip and property valuations go down. On the other hand inflation caused by rising building materials or supply chain disruptions will result in higher construction costs that will reduce the profits hence making it difficult for Arkade Developers to keep making money from them as well as to deliver their projects on time they had planned.

Regulatory Changes

It has been established that the real estate sector in India is highly regulated and altering government policies, zoning laws or environmental policies has more remarkable implications for project feasibility and time lines. Adherence to the Real Estate (Regulation and Development) Act (RERA) among other local regulations need be strict if any lapses are to be avoided otherwise fines or delay might be experienced in terms of completion of a certain project. What more? Taxation policy changes like that of Goods and Services Tax (GST) are also capable of modifying thus affecting pricing strategies as well as total cost structure.

Competitive Landscape

Arkade Developers operates in a highly competitive business environment characterised by stiff competition from established developers such as Godrej Properties, Macrotech Developers and Keystone Realtors. Despite strong financial performance, Arkade has not developed a significant market share or brand name recognition compared to its larger competitors. For instance, for the fiscal year FY24 Arkade’s revenue stood at ₹635.71 crore which although substantial is still lower than those of its bigger peers whose revenues run into thousands of crores; thus this creates competitive tension that may impact on pricing policies and demand generation strategies.

Conclusively therefore, even though Arkade developers possess solid foundations for growth they need to contend with various markets as well as regulatory issues together with record levels of rivalry in order to maintain their output levels while they also take advantage of opportunities available in the property development field.

7- GMP (Grey Market Premium) and Subscription Status

A lot of people are excited about the Arkade Developers IPO which is set to open on 16th September, 2024. This article gives an elaborate discussion on its grey market performance, subscription status and investor sentiment:

GMP Trend

- Grey Market Performance: The shady market premium (GMP) of Arkade Developers is presently about ₹63, which shows a 49% margin over the higher price band of ₹128. This denotes high interest and affirmative attitude among investors before the IPO launch.

Subscription Status

Subscription Breakdown: The IPO is configured in such a style:

- Qualified Institutional Buyers (QIBs): half of the total issue size (₹204 crore).

- Non-Institutional Investors (NIIs): fifteen percent (15%) of the total issue size (₹61 crore).

- Retail Investors: thirty-five percent (35%) of total issue size (₹143 crore).

There will be notable attention from different segments with regard to IPOs especially because of solid GMP and company’s profitability.

Investor Sentiment

- Market perception: Investor sentiment seems to be quite optimistic due to Arkade Developers’ remarkable financial growth, which includes an increase in revenue by 183.84% year-on-year to ₹635.71 crore in FY24, and net profit doubling to ₹122.81 crore. As such, this good performance raises the attractiveness of the company as an investment option.

- Early investor interest: Analysts and market experts have a positive outlook toward this IPO citing Arcade’s established history in the Mumbai real estate market and its ongoing projects among others. The firm’s growth potential together with the favourable market environment is expected to result in high subscription levels.

In conclusion, Arkade Developers IPO has favourable positioning within the stock market characterised by strong GMP signals, well-structured subscription plans and positive investor morale giving rise to a prospective offering.

8- Arkade Developers IPO: Application process

Here’s a step-by-step guide on how to apply for the Arkade Developers IPO:

Applying through ASBA

- If you do not already have a Demat account, open one now. Holding the shares that have been assigned to you requires this.

- Submit your IPO application through the ASBA (Application Supported by Blocked Amount) facility. You can do this either online through your bank’s website or offline by visiting a bank branch.

- Ensure your ASBA account has sufficient funds to cover the application amount. The money will be blocked until the shares are allotted to you.

- Provide your Demat account details while applying so the allotted shares can be credited to your account.

Applying through UPI

- Link your bank account to your UPI ID if not done already.

- Make sure you have sufficient funds in your bank account for the application amount.

- Download a UPI app like BHIM, PhonePe, Google Pay, etc. and create a UPI PIN.

- When applying through a broker or bank’s website, select the UPI option and enter your UPI ID and PIN to complete the application process.

Applying through Broker Platforms

- Open a trading and Demat account with a stockbroker if you don’t have one.

- Log in to your broker’s online platform and navigate to the IPO section.

- Enter the number of shares you want to apply for and complete the application process.

- Ensure you have sufficient funds in your trading account to cover the application amount.

9- CONCLUSION

The Arkade Developers IPO presents as a superb opportunity with solid financials, an extensive project pipeline, and an expanding presence in the Mumbai real-estate sector which always has high demand. In FY24, revenue has grown by 184% whereas net profit has doubled which shows the operational efficiency and market potential. This is further buttressed by the company’s concentration on residential and redevelopment projects as well as its experienced management team.

There are risks that investors should put into consideration. The area of real estate is still impacted by such factors like market volatility; surging building costs; and regulatory impediments which may result into Arkade’s profitability and extending time frames for its projects. Furthermore, despite rapid growth, Arkade is confronted with a stiff competitive environment from bigger developers like Godrej Properties and Macro Tech Developers that have been in this industry for many years now. Its market share, though expanding, is still relatively tiny compared to the two giants.

On a positive note though, the IPO’s grey market premium (GMP) signals robust investor enthusiasm registering possible profits of up to 49%.This indicates that investors have faith concerning its future. Money from these IPOs will be utilised in order to support ongoing construction projects as well as buy lands making Arkade poised for future developments. Although the company seems promising financially; attention should be given to both competitive forces and international regulations.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.