Waaree Energies IPO GMP: In recent times, the solar energy industry has experienced a steady growth curve, more so in India, considering the global demand for alternative sources of energy is on the rise. Clean and sustainable energy has been considered the centre of this solar revolution. Waaree Energies Limited, the first solar PV module manufacturing company in India, has plans to raise ₹4,321.44 crores through an Initial Public Offering. The aim of this is to take its diversification a notch higher by venturing into larger and more advanced manufacturing facilities as well as position itself in an already saturated market.

Table of Contents

1. Overview of Waaree Energies Limited

Founded in December 1990, Waaree Energies today stands as the biggest manufacturer of solar PV modules in India with annual production capacity of 12 GW. Trust in Waaree has been established over a span of thirty years both in the Indian market and outside as they have been providing their services to a wide range of clientele. Their core competency lies in high performance PV products – monocrystalline, polycrystalline and TopCon modules manufacturing. These residential and commercial modules are further supported by Waaree robust distribution D and support network.

Key Products and Solutions

Waaree’s offerings cater to various sectors, encompassing renewable energy, electronics, and solar engineering. Its most notable products include:

- Monocrystalline Modules: Known for high efficiency and durability, suitable for large-scale solar farms.

- TopCon Modules: Advanced bifacial modules that capture solar energy from both sides, increasing overall efficiency.

- Flexible and Frameless Modules: Designed for specialty applications, including residential installations with space constraints.

- Solar Inverters, Storage, and EPC Solutions: Supplementary products that provide end-to-end solar solutions, further enhancing the company’s portfolio and market reach.

The company operates four ISO-certified manufacturing facilities located in Gujarat (Surat, Tumb, Nandigram, and Chikhli). These facilities span a combined area of 136.3 acres, equipped with advanced machinery to produce quality, efficient, and durable solar modules. The company has also expanded its distribution globally, reaching over 20 countries, making it a strong player in the renewable energy space.

2. Waaree Energies IPO Overview and Structure

The Waaree Energies IPO consists of a new issue of 2.4 crores shares amounting to ₹3,600 crores and an Offer for Sale (OFS) of 0.48 crores shares of ₹ 721.44 crores. The price band for the IPO has been fixed at ₹1427 to ₹ 1503 per share with a minimum lot size of 9 shares, thus making the minimum retail investment at approximately ₹ 13,527.

IPO Key Dates and Timeline

- Bidding Window: October 21, 2024 – October 23, 2024

- Allotment Finalisation: October 24, 2024

- Listing on BSE & NSE: October 28, 2024

Stellar Demand and Impressive Subscription Rates

The Waaree Energies IPO has received stupendous response from the investors and it has been subscribed by 76.34 times. Bids were made for 160.91 crore equity shares, which is way ahead of the share allocation of 2.10 crore shares. The IPO received total subscriptions amounting to rupees 2.41 lakh crores which makes it one of the biggest issues in the recent times.

Breakdown of Subscription Categories:

- Retail Investor: Demanding investor audience can also be seen in the retail category of the IPO which was oversubscribed by 10.79x.

- Non-Institutional Investors (NIIs): Non-institutional investors fared better too where their segment was oversubscribed by 62.49 times.

- Qualified Institutional Buyers (QIBs): The category for institutional French, the section reserved for the largest institutional investors, was forecasted at an unrepeatable level. The graph demonstrated a 208.63 times oversubscription with regard to the offered shares’ amount which indicates very confident investors, that are large financial corporations.

The IPO reserves shares for different investor categories:

- Qualified Institutional Buyers (QIBs): 56,63,925 shares (19.7%)

- Non-Institutional Investors (NII): 42,47,945 shares (14.77%)

- Big NII (bNII): 28,31,963 shares (9.85%)

- Small NII (sNII): 14,15,982 shares (4.92%)

- Retail Individual Investors (RII): 99,11,869 shares (34.47%)

- Employees: 4,32,468 shares (1.5%)

- Anchor Investors: 84,95,887 shares (29.55%)

Waaree Energies secured ₹1,276.93 crore from anchor investors on October 18, 2024, signalling strong institutional interest. The anchor allocation included 8,495,887 shares at the upper price band of ₹1,503 per share.

3. Financial Performance and Metrics Analysis

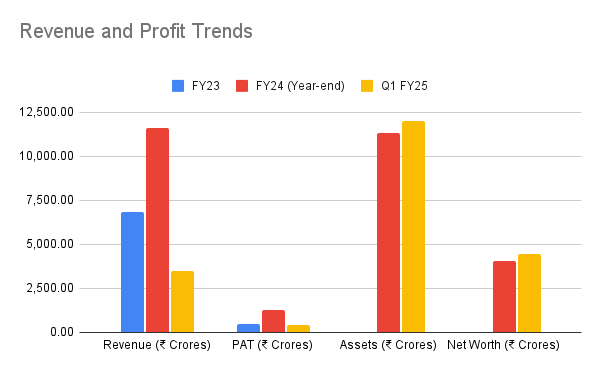

The chart depicting Waaree Energies’ financial growth trajectory shows trend in revenues and profits in the robust range backing its operational model and possibilities of further growth. The financial highlights, available in the company’s filings and other performance data, are given in the section below:

Revenue and Profit Trends

- Revenue Growth between FY23 and FY24: An impressive revenue growth of 70% mostly achieved due to escalating sales volume, added production capabilities, and increasing appetite for renewable energy products.

- Profit After Tax (PAT): A significant increase of 155% in PAT from FY23 to FY24 demonstrating growth in profitability.

| Metric | FY23 | FY24 (Year-end) | Q1 FY25 |

| Revenue (₹ Crores) | ₹6,860.36 | ₹11,632.76 | ₹3,496.41 |

| PAT (₹ Crores) | ₹500.28 | ₹1,274.38 | ₹401.13 |

| Assets (₹ Crores) | – | ₹11,313.73 | ₹11,989.48 |

| Net Worth (₹ Crores) | – | ₹4,074.84 | ₹4,471.71 |

Key Financial Ratios

- Return on Equity (ROE): 8.79% for Q1 FY25

- Return on Capital Employed (ROCE): 9.45% for Q1 FY25

- Debt-to-Equity Ratio: A low debt-equity ratio of 0.06, showcasing financial prudence

- PAT Margin: 11.47% for Q1 FY25

The rise in Waaree’s ROE and ROCE is indicative of the efficient deployment of capital resources by the firm. Its financial stability is further demonstrated by its low debt to equity ratio, thereby minimising any associated risks of using debt to fund operations.

Valuation Metrics

By taking into account the earnings of Waaree before and after its IPO, the following valuation metrics can also be used to arrive at the pricing of Waaree’s shares:

- Price-to-Earnings (P/E) Ratio: Pre-IPO P/E is 30.87, while post-IPO P/E is 26.76, placing it at a reasonable valuation for investors.

- Market Capitalization: Expected post-IPO market cap stands at ₹42,939.36 crores, positioning Waaree among India’s top renewable energy companies.

4. Promoters and Management

Waaree Energies’ core promoters include Hitesh Chimanlal Doshi, Viren Chimanlal Doshi, Pankaj Chimanlal Doshi, and Waaree Sustainable Finance Private Limited, who have significant experience in the solar energy sector. With a pre-IPO stake of 71.80%, their post-issue holding will decrease slightly to 64.30%. This modest dilution indicates the promoters’ confidence in the company’s growth prospects.

Corporate Governance and Future Vision

The management strategy is centred on making Waaree a solar module manufacturing company through the use of advanced technologies, increasing its production capacity, and getting all facilities ISO certified. The 6 GW plant coming up in Odisha is an important project that has been initiated in order to satisfy the increasing demand for products and to enhance the market share of Waaree.

5. Industry Overview and Market Position

In the past few years, the energy sector, especially the renewable sector has shown a great deal of transformation as individuals and even institutions have started to even appreciate cleaner sources of energy. In India, policies like the National Solar Mission or state-based programs have promoted the use of solar energy. Stand-alone India’s solar market has a capacity of more than 100 Gigawatts while the nation has set a bold target of attaining 500 Gigawatts of renewable capacity by the year 2030, which opens up huge opportunities for Waaree Energies and other concerned players.

Competitive Landscape and Market Dynamics

Waaree Energies is a leading manufacturer in the Solar PV segment with a 12 GW capacity thereby appreciably increasing the share of solar power capacity in India. In the competition dominated engulfed by Tata Power Solar, Adani Solar, Vikram Solar, Due to its capabilities, Waaree is leading:

- Advanced Technology: Incorporation of high-efficiency modules like TopCon, offering a competitive edge in the marketplace.

- Comprehensive Product Line: A versatile product range catering to diverse applications.

- Global Reach: Operational reach of Waaree over 20 countries gives it an upper hand in international markets as there is a high demand for quality solar modules.

6. Investment Rationale

Strengths

- Major Market Position: Claims to be the top solar PV manufacturer in India generating 12 GW otherwise known as gigawatts.

- Financial Performance: Impressive revenue growth, earning margin, and a healthy financial structure with little gearing.

- Market Strategy: New manufacturing capacity of 6 GW in Odisha will lead to enhancement of production levels and cut down operation costs.

- International Reach: Herge’s global expansion helps her earn a well trusted international brand.

- Quality assurance: Implementation of ISO in the operations of Waaree attests to their dedication towards quality and safety.

Growth Opportunities

- Widening Demand for Renewables: In light of the ambitious goals set by the Indian government, Waaree is in a favourable position to take advantage of the ever-growing demand for renewable energy sources.

- Technological Improvements: The use of more sophisticated technologies in the manufacture of solar modules, such as bifacial modules, increases efficiency and opens new markets.

- Economies of Scale: By upscaling its deployment, Waaree will be able to decrease the costs of production, which will enhance its competitive position in the market even more.

Potential Risks

- Industry Competition: As more players enter the solar space, Waaree may face pricing pressure.

- Policy Dependence: The renewable sector’s dependence on government policies poses regulatory risks.

- Currency Fluctuations: Waaree’s global operations expose it to foreign exchange risks.

7. Steps to Check Allotment Status

Waaree Energies’ IPO allotment status can be checked via various online platforms, including the official websites of BSE and Link Intime India Private Ltd, the registrar for this IPO. Here’s a quick guide for investors to verify their allotment status:

On BSE Website:

- Visit the BSE website.

- Select ‘Equity’ under Issue Type.

- In the Issue Name area, select ‘Waaree Energies Limited’ from the list of possibilities.

- Enter either your Application Number or PAN.

- Press ‘Search’ after selecting ‘I am not a robot’.

On Link Intime Website:

- Go to the Link Intime registrar website.

- Select ‘Waaree Energies Limited’ by clicking on the Select Company dropdown box.

- Enter details like PAN, Application Number, DP ID, or Account Number.

- Click ‘Search’ to view your allotment status.

8. Grey Market Premium (GMP) Highlights

The current Gray market for Waaree Energies IPO has been fun filled as shares were being quoted at an impressive premium of Rs 1558 a share. This translates to an expected share price of Rs 3061 a share on listing which is a 104 percent premium on the upper IPO price of Rs 1503. The fact that high grey market premium (GMP) is observed is a very encouraging sign as it reflects aggressive buying interest among investors and thus upper listing day performance is expected.

9. Conclusion

The Waaree Energies IPO is an inviting option for investors intending to make their first investment in the renewable sector. The company commands a strong market, exhibits remarkable financial figures, and possesses an aggressive growth strategy, all of which put forward a good case for investment. Nonetheless, they caution that the industry also comes with its regulatory and competitive risks, which potential investors must be aware of. As Waaree embarks on this new chapter, the IPO is a unique opportunity to become a part of the green energy revolution in India with benefits expected to come years down the line, and thus the expected returns are high.

The skyrocketing number of subscriptions and hefty premium in the grey market indicates that Waaree Energies has worked its charm on investors in all classes. As the dates of the listing are drawing closer, it appears that Waaree Energies is ready to make a remarkable entry into the bourses which may even raise the standards for the other companies in the renewable energy sector. While the investor’s focus shifts quickly to the listing, both the listed equities and the high GMP along with the very high demand are positive for the future performance of Waaree Energies in the rapidly developing renewable energy sector in India.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.