Northern Arc Capital Limited (NACL), a prominent silent engine of finance services platform in India, is proposing its Initial Public Offering (IPO) from September 16 to September 19, 2024. This IPO has caught the eye of many people because of the company’s special method of meeting the requirements of people with poor financial services and offering complete financial services to different industries. In this blog post, we will discuss the Northern Arc Capital IPO comprehensively including critical details such as issue size, price range, financial status and crucial facts on investment so that investors may base their decisions on reliable information.

Northern Arc Capital IPO details

- IPO Opening Date: September 16, 2024

- IPO Closing Date: September 19, 2024

- Price Band: ₹249 to ₹263 per share

- Issue Size: ₹777 crore

- Listing on: BSE and NSE

- Minimum Lot Size (Retail): 57 Shares

- Maximum Lot Size (Retail): 13 Lots (741 shares)

- Offer Type: Fresh Issue of 19.01 million shares and Offer for Sale (OFS) of 10.53 million shares

- Anchor Investors: ₹228.86 crore raised on September 13, 2024

- Tentative Listing Date: September 24, 2024

Breakdown of the Issue

Northern Arc Capital IPO details: The Northern Arc Capital IPO is a book-built issue that consists of both fresh shares and an offer for sale (OFS). The fresh issue aggregates up to ₹500 crore, while the OFS will see 10.53 million shares sold, raising ₹277 crore. A key aspect of this IPO is the employee reservation of 590,874 shares at a discount of ₹24 per share.

- Total Issue Size: ₹777 crore

- Fresh Issue: ₹500 crore (19.01 million shares)

- Offer for Sale: ₹277 crore (10.53 million shares)

- Employee Reservation: 590,874 shares at a discount of ₹24 per share.

Northern Arc Capital IPO Lot Size and Investment Limits

The design of the IPO has been structured for many classes of investors ranging from retail investors to High Net-worth Individuals (HNIs), as well as Qualified Institutional Buyers (QIBs). The table below summarises the minimum and maximum number of shares an investor can apply for:

| Investor Type | Minimum Shares | Minimum Investment (₹) | Maximum Shares | Maximum Investment (₹) |

| Retail | 57 | ₹14,991 | 741 | ₹194,883 |

| S-HNI | 798 | ₹209,874 | 3,762 | ₹989,406 |

| B-HNI | 3,819 | ₹1,004,397 | N/A | N/A |

For retail investors, the minimum bid size is 57 shares, which equates to an investment of approximately ₹14,991 at the upper end of the price band.

Northern Arc Capital ipo details: Business Overview

It was in the year twenty-oh-nine that Northern Arc Capital Limited was founded primarily to provide retail loans to underprivileged households as well as businesses in India. The company has established a significant presence in sectors such as MSME financing, microfinance, vehicle financing, and affordable housing financing. Their comprehensive business model allows them to extend financing to various borrower categories and geographies, making them a significant player in India’s retail credit ecosystem.

As of March 31, 2024, Northern Arc Capital has enabled approximately ₹1.73 trillion in funding, impacting 101.82 million lives in India. The company operates in 28 states and seven union territories, with assets under management (AUM) of ₹117,100.19 million.

Key Business Segments:

- Lending: Providing loans from the company’s balance sheet to originator partners and underserved customers.

- Placements: Facilitating credit for partners through various financial products.

- Fund Management: Managing portfolio management services (PMS) and debt funds with assets of ₹120,785.58 million across ten alternative investment funds (AIFs) and three PMS.

Technology and Innovation

Northern Arc Capital has developed an in-house technology stack consisting of:

- Nimbus: A debt platform for processing debt transactions.

- nPOS: A co-lending and co-origination solution.

- Nu Score: A machine learning-based underwriting module.

- AltiFi: A retail debt investment platform.

This technology suite allows Northern Arc to serve clients more efficiently and scale operations across different sectors.

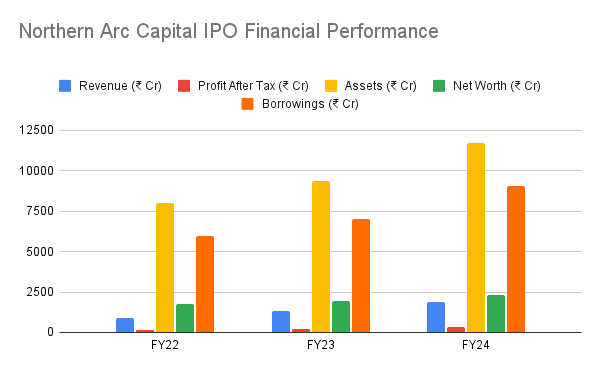

Financial Performance

Northern Arc Capital has shown consistent growth in both revenue and profits over the last few years, reflecting its strong business fundamentals.

| Financial Year | Revenue (₹ Cr) | Profit After Tax (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) | Borrowings (₹ Cr) |

| FY22 | 916.55 | 181.94 | 7,974.12 | 1,739.04 | 5,982.96 |

| FY23 | 1,311.20 | 242.21 | 9,371.57 | 1,955.39 | 7,034.57 |

| FY24 | 1,906.03 | 317.69 | 11,707.66 | 2,314.35 | 9,047.76 |

Company’s revenue rose 45% and in FY24, PAT (profit after tax) increased 31%. This indicates a capacity for extending operations at a profit.

Key Financial Metrics:

- Debt/Equity Ratio (FY24): 3.9

- Return on Net Worth (RoNW): 13.32%

- Net Interest Margin (NIM): 8.33%

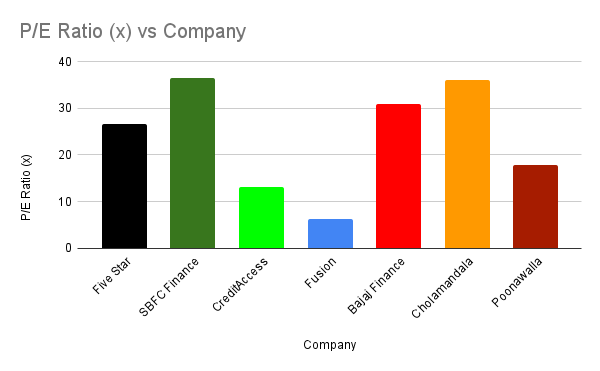

Valuation and Pricing Analysis

At ₹263 per share, the company wishes to attract a market capitalisation of ₹4,242.86 crore. The IPO has been offered at this price range against books worth 13.36 times those for FY2024, suggesting that it’s more attractive than most of its competitors in the sector.

| Company | P/E Ratio (x) |

| Five Star Business Finance | 26.76 |

| SBFC Finance | 36.64 |

| CreditAccess Grameen | 13.12 |

| Fusion Microfinance | 6.21 |

| Bajaj Finance | 30.93 |

| Cholamandalam Investment | 36.22 |

| Poonawalla Fincorp | 17.81 |

As seen in the table, Northern Arc Capital is priced competitively within the financial services sector.

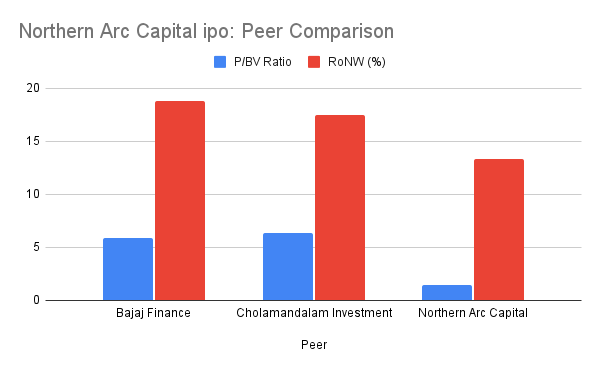

Peer Comparison

Several notable companies are competitors of Northern Arc Capital, for example Bajaj Finance, Five Star Business Finance, and Cholamandalam Investment to mention just a few. Its diversified business model and emphasis on untapped markets distinguishes it from other competitors. The target sectors of MSME financing include microfinance and consumer finance thus creating a niche positioning in these lines of business.

| Peer | P/BV Ratio | RoNW (%) |

| Bajaj Finance | 5.89 | 18.84 |

| Cholamandalam Investment | 6.38 | 17.46 |

| Northern Arc Capital | 1.49 | 13.32 |

Compared with its more esteemed competitors such as Bajaj Finance and Cholamandalam Investment, Northern Arc Capital is a fascinating investment option given its lower P/BV multiple of 1.49x.

Northern Arc Capital ipo details: Investment Insights and Strategy

When contemplating an investment in an IPO it is imperative to ascertain both the short term listing possibilities and long term growth prospects of the company under consideration. Let’s assess Northern Arc Capital’s IPO from each point of view:

For Short-Term Investors:

For those seeking quick profits through listing gains, Northern Arc Capital has fair prices relative to its competitors as well as sound financial performance thus making it a potential candidate for such short-term proceeds. Already, the company has raised ₹228.86 crore from anchor investors which indicates there is good institutional demand hence good chances of positive listing performance.

At P/E ratio 13.36x however, its pricing is much lower when compared with all other players in the broader financial services sector hence leaving room for possible price increment post-issue launch but this will depend on market outlooks too.

Key factors supporting short-term gains:

- Insatiable appetite from anchor investors

- Relative cheapness in comparison with competitors

- Robust and burgeoning finance industry in India

But at the time of listing, actual price at which shares are traded will depend much on market conditions then existing. Also, investors must think about factors like market fluctuations, movements of interest rates and aggregate economic scenarios which might be harmful to initial performance of the stock.

For Long-Term Investors:

In terms of long-term investing, Northern Arc Capital seems firmly set with respect to constant returns which is mainly due its concentration on the unserved retail credit industry in India. The firm has distinguished itself by providing products across different sectors such as MSME finance, affordable housing finance, and vehicle loans.

The technology-led approach coupled with the wide range of products offered helps the company run its operations efficiently as well serving a bigger number of clients. Besides, strong financials evidenced by consistent revenue and profit growth reveal good fundamentals.

Factors that favour long-term investment:

- A diverse loan portfolio covering different markets with less attention.

- Years of continued revenue or profit increases.

- Return ratios that are strong RoNW (13.32%) and NIM (8.33%).

- Platforms such as Nimbus, nPOS and Nu Score which employ advanced technology.

This IPO would be attractive to investors who have medium or long horizons particularly those wishing to gain insight into the expanding financial services sector in India. Investors are likely going to find Northern Arc Capital’s business model and its capability of reaching unserved markets appealing within this sector where growth prospects abound for them.

Strengths and Weaknesses of Northern Arc Capital IPO

Equally, just as any other investment not only are there strengths but also risks attached to it; thus one has to look at them while considering investing in Northern Arc Capital’s IPO. Key points in this regard include:

Strengths:

- Distinctive Focus on Underserved Segments: Focusing on sectors like MSME financing, affordable housing, and microfinance enables Northern Arc Capital to attract clients who generally lack access to formal financing from traditional banks hence providing the company ample opportunity for growht.

- Technological Innovations: The company’s proprietary technology platforms such as Nimbus, Nu Score etc., allow it to manage credit risk efficiently while reaching out to untapped populations as well as scaling its operations rapidly.

- Strong Financial Performance: A 45% rise in revenue and 31% increase in profit after tax during FY24 by Northern Arc indicates profitable scalability of operations.

- Diversified Revenue Streams: By having its revenue derived from a wide array of lending services, the company is shielded against downturns in specific sectors.

- Experienced Management Team: The Northern Arc Capital leadership team boasts of extensive experience in finance and risk management which has enabled them to develop an efficient and sustainable business model.

Weaknesses/Risks:

- High Debt Levels: Company uses leverage overmuch as seen in its 3.9x debt-equity ratio. Hence higher debts imply a lot of risks especially when interest rates are increasing.

- Concentration on Financial Services Sector In India: Northern Arc Capital is largely subject to economic cycles in India, although it benefits from focusing on areas that are not well serviced by others. Any downturns in the Indian economy or any problems within its financial sector would have an impact on its operations.

- Competitive Landscape: Northern Arc faces stiff competition from established players such as Bajaj Finance, Cholamandalam and Five Star Business Finance. As these companies continue to expand, Northern Arc will need to differentiate itself to maintain its competitive edge.

- Credit Risk: Because Northern Arc provides loans specifically meant for coffee farmers who are not well served by conventional banks, it has a higher credit risk profile compared to traditional banks. Utilizing technology solutions may help manage some risks but they cannot completely overcome difficulties presented with lending beta customers who are more likely than most standard ones default on their debts.

- Market Sentiments and Volatility: IPO performance often depends upon the general condition of the market during listing time. The stock’s performance could be affected by factors like global economic conditions, stock price volatility; as well as investor sentiments at this moment in time.

Northern Arc Capital IPO application process

Every individual dealing with shares in this IPO of Northern Arc Capital must possess a blocked amount application supported by banks or UPI systems and apply via their bank’s online platform or any trading site of choice. Below is a step-by-step guide to follow:

Applying through Net Banking (ASBA):

- Log into your net banking account.

- Navigate to the ‘IPO’ section under the investments tab.

- Select ‘Northern Arc Capital IPO’ from the list of available IPOs.

- Enter the number of shares you wish to bid for and the price (within the price band).

- Confirm and submit your application.

Applying through UPI (Brokerage Platforms):

- Open your brokerage app and select the IPO section.

- Find ‘Northern Arc Capital IPO’ from the list of upcoming IPOs.

- Enter the number of shares and bid price.

- Confirm your application and approve the mandate in your UPI app.

- Wait for the allotment results, which are typically announced a few days after the IPO closes.

Northern Arc Capital IPO Allotment and Listing Details

Northern Arc Capital’s IPO shares allocation will be done on September 24, 2024, and this would be matched by refunds for unsuccessful applications the same day. Therefore, returns for covered bidders will be by September 25, 2024 in their Demat accounts. Shares have an estimate to get even listed on BSE or NSE by September 26, 2024.

Allotment Dates:

- Finalisation of Basis of Allotment: September 24, 2024

- Refunds Initiation: September 24, 2024

- Credit of Shares to Demat Account: September 25, 2024

- Listing Date: September 26, 2024

Investors can check their allotment status online through their broker or on the IPO registrar’s website (typically Link Intime or KFin Technologies).

Conclusion:Northern Arc Capital IPO

The IPO of Northern Arc Capital provides both short and long term investors an attractive investment opportunity. The company has a diverse portfolio, technology-driven operations, and consistent financial performance that make it a key player in India’s financial services industry, particularly in unexplored markets. It is also a compelling choice for short-term gains due to its competitive pricing relative to peers and strong anchor investor interest which may result in robust listing gains.

However, the company’s growth trajectory, focus on innovation and ability to cater to high-growth segments such as MSME finance and microfinance make a strong case for sustained growth in future years for long-term investors.Despite high debt levels and competitiveness, Northern Arc’s strong business fundamentals and strategic positioning help to reduce some of these risks.

Investors should assess their risk profile, investment timeframe as well as wider market conditions before drawing their subscriptions. Overall, Northern Arc Capital’s IPO presents an opportunity for diversification into a portfolio that could be promising especially for those seeking to tap into India’s ever-growing financial services sector.

FAQs

1- Price band for Northern Arc Capital IPO is?

Each share may be bought at ₹249 to ₹263.

2- When will the Northern Arc Capital IPO open and close?

The IPO will begin on September 16, 2024 and end on September 19, 2024.

3- What is the lot size for retail investors?

The minimum lot size is 57 shares, and the maximum for retail investors is 741 shares.

4- What are the risks associated with investing in Northern Arc Capital IPO?

The key risks include high debt levels, competition from established players, and credit risks associated with lending to underserved segments.

5- When will the Northern Arc Capital IPO be listed on exchanges?

The shares are expected to list on September 26, 2024, on the BSE and NSE.

6- Can I apply for the Northern Arc Capital IPO through my broker’s mobile app?

Yes, you can apply for the IPO through your brokerage app using the UPI system. Ensure your UPI ID is linked with your bank account for the transaction to proceed smoothly.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.