The cabinet of ministers headed by Modi has adopted a unified pension scheme for government workers. For central government employees, this would replace the previous national pensions scheme with an improved version that takes care of their long-time complaints with regard to retirement benefits. This page will detail the main aspects of the UPS, distinguish it from the NPS and investigate its implications on state and central civil servants.

Table of Contents

What is the Unified Pension Scheme (UPS)?

The Unified Pension Scheme is a fresh pension system that has been legalised for the benefit of central government workers, it is aimed at providing certain benefits at the end of service. It answers most of the worries surrounding NPS, especially its relatedness to markets which causes uncertainty in pensions’ returns. The executive arm of this scheme would see its implementation from April 1st, 2025; thus allowing government employees to select either NPS or UPS.

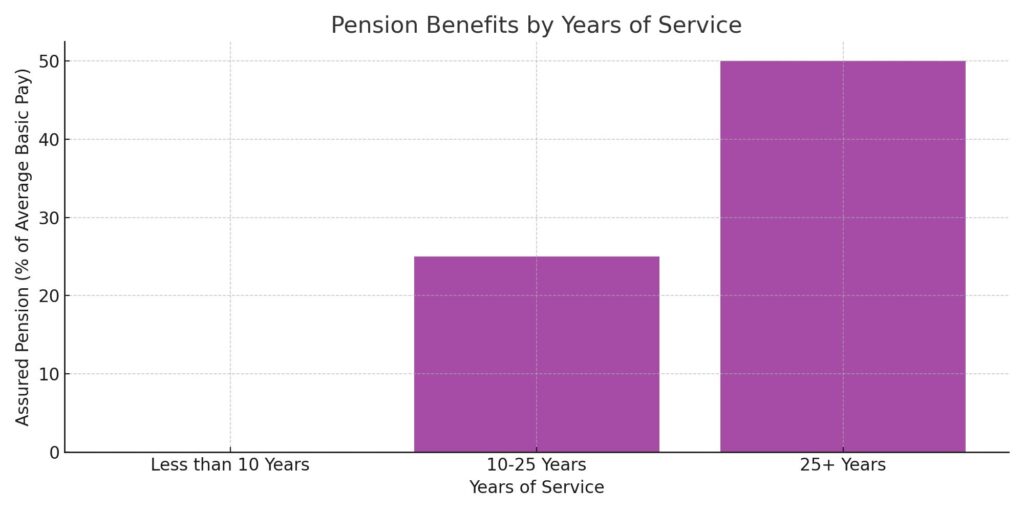

Unified Pension Scheme Benefits Based on Years of Service

| Years of Service | Assured Pension (as % of Average Basic Pay) | Minimum Assured Pension (Rs/month) |

| 25+ Years | 50% | Rs 10,000 (adjusted for inflation) |

| 10-25 Years | Proportional | Rs 10,000 (adjusted for inflation) |

| Less than 10 Years | None | Rs 10,000 (adjusted for inflation) |

Main Key Features of the Unified Pension Scheme

The UPS is structured around several core pillars to ensure that government employees and their families receive financial security post-retirement. Here are the salient features:

- Assured Pension: 50% of an employee’s average basic pay for the last 12 months before retirement will be paid as a pension to government employees. The minimum period in which one must serve is 25 years. For those who have worked between 10 and 25 years, their pension amount would be adjusted proportionately.

- Family Pension: In the unfortunate event of an employee’s demise, his/her family will receive 60% of the pension that he/she was receiving before death.

- Minimum Pension: Even if an employee has served for at least 10 years, he/she will still be entitled to a minimum of Rs 10,000 monthly. When adjusting for inflation, this may well mean around Rs 15,000 now.

- Inflation Indexation: All pensions under the UPS (including assured pension, family pension and minimum pension) will be indexed to inflation., which means they would be adjusted periodically on the basis of AICPI-W(AICPI for Industrial Workers) throughout India to keep retirees’ purchasing power intact.

- Lump-Sum Payment: After retirement or superannuation, an employee shall receive on top of his/her monthly pension a lump-sum amount equal to 1/10th of his/her monthly emoluments(basic pay + DA) for every completed six months served up until that point in time (including gratuity). The reason for this being it does not reduce any other payment made out by way of a pension scheme in any manner whatsoever.

How UPS Differs from NPS

The UPS introduces significant changes compared to the NPS, offering more security and predictability:

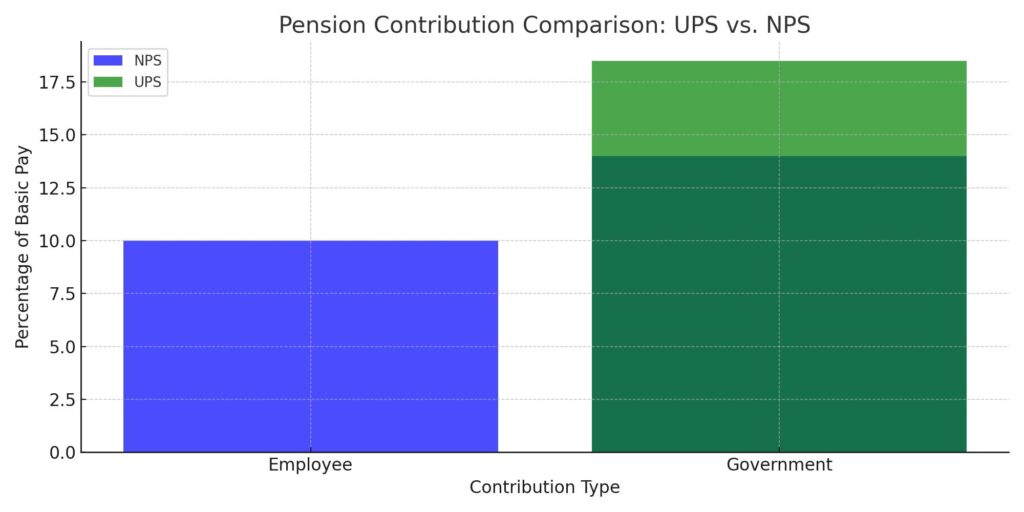

- No Contribution Required: NPS has employees contributing 10% of their basic pay towards pensions while the government gives 14%. But UPS never forces its workers to give it anything. To promote greater safety and reduce costs to employees’ out-of-pocket expenses, it provides an 18.5% contribution on basic pay that is submitted by the government.

- Market Independence: In contrast with this scheme there is a reliable pension paid out regardless of stock market movements just like UPS does. The reason being that the workers might be worried about how such changes would affect them after their retirement.

- Guaranteed Pension: NPS does not assure a fixed amount of pension while UPS guarantees its employees 50 percent of their last salary as a retirement payment which can be spent just after one gets his/her pension or even later when he/she passes away.

Comparison of Pension Schemes: UPS vs. NPS

| Feature | Unified Pension Scheme (UPS) | National Pension Scheme (NPS) |

| Employee Contribution | None | 10% of basic pay + DA |

| Government Contribution | 18.5% of basic pay | 14% of basic pay + DA |

| Pension | 50% of average basic pay over the last 12 months | Market-linked, no guaranteed pension |

| Family Pension | 60% of pension received before employee’s death | Varies, based on accumulated corpus |

| Minimum Assured Pension | Rs 10,000 per month (adjusted for inflation) | None |

| Lump-Sum Payment | 1/10th of monthly emolument per 6 months of service | Based on accumulated corpus |

| Inflation Indexation | Yes, based on AICPI-W | Not applicable |

| Market Dependency | No | Yes |

Impact on Central and State Government Employees

The UPS will provide aid to around 23 lakh central government employees at first. Besides, the state governments can also choose to adopt the UPS which may raise the total number of beneficiaries to about 90 lakh employees in the country.

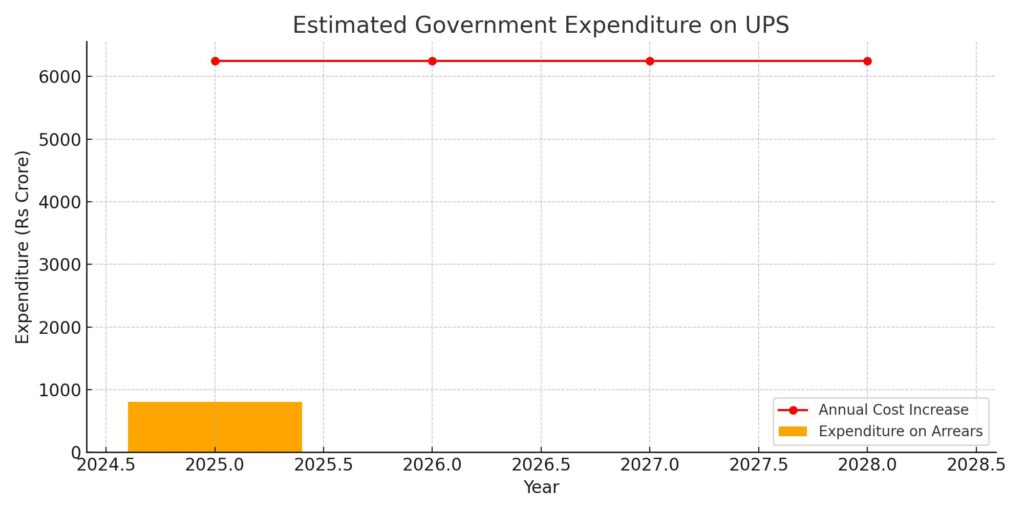

There are serious financial concerns since Rs800 crore is likely to be spent by the government for arrears and an amount of 6,250 crores will be required for annual rise in expenses only during the first year. Nevertheless, because of these reasons social security offered through UPS makes it priceless for the welfare of such personnel.

Why Was the UPS Introduced?

The UPS was initiated because there was a significant disenchantment with the NPS, more especially by civil servants who were worried that the returns were not certain and markets could be dangerous. In response to this, Prime Minister Modi constituted a committee under the chairmanship of cabinet secretary TV Somanathan to investigate other options and enhancements to the current pension systems.

A wide-ranging dialogue between various stakeholders, including different government organisations, Reserve Bank of India, and also international organisations like World Bank, took place in front of the committee. This committee’s advice ultimately led to the establishment of UPS as an attempt at providing a stronger and safer retirement scheme for civil servants.

Unified Pension Scheme in The Political Context

UPS has been pronounced when it matters most, as close up are elections even in states like Jammu and Kashmir, and Haryana. Because this directly deal with one of the topnotch requirements of those who work for the government, the administration’s proposal on a better pension system for employees might have major political implications.

Future Implications of Unified Pension Scheme

The development of the UPS is a remarkable revolution in India’s pension system as it primarily affects government workers. There is expanding acknowledgment of the need for stable and predictable retirement benefits in this age of increasing economic uncertainty. Therefore, because it guarantees pensions, the UPS may lead to possible reforms in pensions that could be adopted by other sectors.

For government workers, nothing can compare with the UPS among other more secure and reliable options like NPS. But picking between these two will depend greatly on someone’s specific preferences or goals when it comes to financing their retirement. Before settling on anything, employees must consider such factors as their attitude on risk-taking, strategies for planning for retirement as well as income needs during retirement.

Estimated Government Expenditure on UPS

| Year | Expenditure on Arrears (Rs Crore) | Annual Cost Increase (Rs Crore) |

| 2025 | 800 | 6,250 |

| 2026 | – | 6,250 |

| 2027 | – | 6,250 |

| 2028 | – | 6,250 |

Conclusion

The Unified Pension Scheme is a well-thought-of action taken by this regime led by Modi which tackles major worries expressed by government workers and guarantees a safer way after they retire. Employees should keep themselves informed about their choices towards the end of October 2025 in order to make decisions that would help them achieve their financial goals.

For those who have joined this NPS program previously; switching over to UPS offers them another chance for securing a pension that they can rely on. It is advisable to contact financial planners or specialists in pensions so that you understand completely what happens with such an adjustment .

In sum, the UPS stands out as a great step forward for all government employees when it comes to pensions in India, providing them with greater safety and relief.

Frequently Asked Questions (FAQs) about the Unified Pension Scheme (UPS)

1. What is the Unified Pension Scheme (UPS)?

TheUnifiedPensionScheme (UPS) is a newly sanctioned pension program for government employees inIndia that provides certain pension benefits. It enables employees to receive a fixed amount as a pension based on their previous salary hence being more reliable than the market drivenNationalPensionScheme(NPS).

2. How is UPS different from the National Pension Scheme(NPS)?

UPS differs from NPS on some key issues:

Employee Contribution: The employee does not contribute any part of his earnings under UPS while NPS requires 10%of his basic pay + DA.

Government Contribution: The government’s total contribution for UPS stands at18.5% compared to14% for NPS.

Pension: A guaranteed pension amounting=50% of his average basic salary over a period of12 months is paid by UPS but there is no fixed pension offered by NPS since it is market based funded.

Family Pension and Inflation Indexation: In addition, according to UPS, better family pensions as well as indexing to inflation are more relevant than what is provided under NPS

3. Who is eligible for the Unified Pension Scheme (UPS)?

The UPS is available to the employees of the central government. The scheme is optional, so an employee may choose between the UPS or NPS. Existing NPS subscribers have the option to switch over to UPS.

4. When will the implementation of the Unified Pension Scheme (UPS) take place?

Implementation of the UPS starts on 1st April 2025.

5. How does UPS calculate his pension?

A UPS pension is equivalent to 50% of average basic pay received in the last 12 months prior retirement provided that a worker has a minimum 25 years’ service. For employees who have less than 25 years but more than 10 years of service, it will be calculated proportionately. The minimum assured pension will be Rs 10,000 per month adjusted with inflation.

6. What are the benefits for the family of the deceased employee under UPS?

In case an employee dies, his or her family will get 60% of the amount of pension he or she was entitled to before death. This guarantees ongoing financial support for the family.

7. How does inflation impact the pension under UPS?

Pensions, family pensions and minimum assured pensions provided under UPS are index-linked to inflation through All India Consumer Price Index for Industrial Workers (AICPI-W). It retains its value over time thus shielding against escalating costs.

8. Will there be a lump-sum payment upon retirement under UPS?

Yes, apart from regular monthly pension, retired employees will also get lump-sums that are equivalent to 1/10th of their last drawn salaries (i.e., basic + DA) for every six months of service at retirement date. Such payment does not interfere with pension amounts.

9. What are the financial implications of the UPS for the government?

Initial expenditure to implement UPS is Rs 800 crore as reported by the government. Costs will increase annually on UPS by Rs 6250 crore from the first year after implementation.

10. Can state governments adopt the Unified Pension Scheme?

Yes, state governments can opt for UPS for their employees; if they do so, then around 90 lakh beneficiaries would increase.

11. What happens to employees currently enrolled in the NPS?

The employees presently enrolled in NPS have the option of switching to Unified Pension Scheme (UPS) if they want.

12. What should employees consider when choosing between UPS and NPS?

When deciding between UPS and NPS, employees should take into consideration factors like secured pension payment guarantee level of government’s contribution towards it, family benefits etc., and how inflation affects them differently. Unlike NPS for example, which depends on market performance while returns are high sometimes, UPS is more predictable because its worth does not change with fluctuations in stock exchanges.