The price of palladium opened at $952.50 per ounce, as of 6:42 p.m. at GMT(+5:30). That’s down 1.07% from the previous day’s palladium price per ounce and down 12.12% since year to date.

The lowest trading price within the last day: $950.00 per ounce. The highest palladium spot price in the last 24 hours: $977.00 per ounce.

Table of Contents

What is palladium?

In the earth crust, palladium can be found as high as 0.015 parts per million making it one of the metals that are most plentiful. The English physicist and chemist William Hyde Wollaston named it after the asteroid Pallas when he made the initial discovery of it in the early 1800s.

The topmost producers of palladium during the early twenty-first century were Canada, Russia, South Africa and the United States. Normally, it is produced as a by-product of copper and nickel ores but this metal has its own distinct advantages.

Being easy to work with, palladium is extensively utilised in electrical and dental instruments plus jewellery where it acts as a substitute for platinum. It may even be beaten into thin leaves for decorative purposes but its main application lies in automobile catalytic converters.

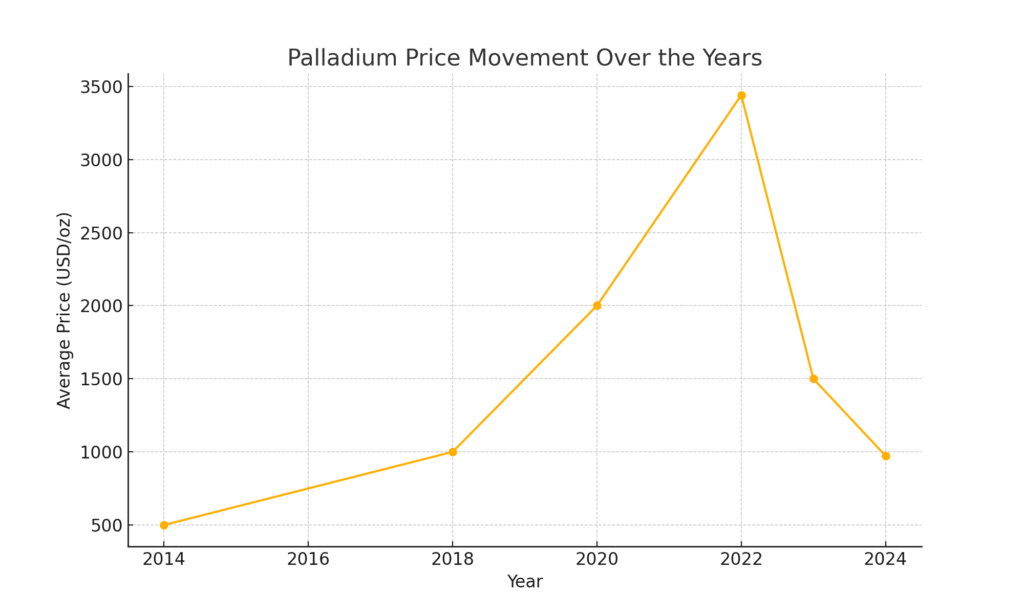

History of palladium price trends

Pricing of palladium increased in the late 20th & early 21st century caused by limited supply and rising demand. The sides of supply are quite restrictive since two out of three major producers of the world i.e., South Africa and Russia do not lack local investment, thus have poor infrastructure causing inconsistent output.

Palladium’s spot price has been moving up and down between $500 – $1000 per ounce for over a decade now. In 2020 and 2021, this silvery metal was on fire surpassing gold at some instances as it traded above $2000 per ounce before declining sharply thereafter.

In March 2022, palladium reached its peak price at $3440 because of low supplies resulting from Russia’s invasion of Ukraine.

Palladium prices have mostly been on a downward trend since that time. In the year 2023, palladium got to below $1500 for about half of the year. It is thought that experts believe electric powered vehicles- which do not have catalytic convertors- could be to blame.

Price Movement Over the Years:

| Year | Average Price (USD/oz) | Notable Events |

| 2014 | $500 | Steady demand from automotive sector |

| 2018 | $1,000 | Increased demand, supply constraints |

| 2020 | $2,000 | Surge due to supply disruptions |

| 2022 | $3,440 | Peak influenced by geopolitical tensions |

| 2023 | $1,500 | Decline attributed to rise in electric vehicles |

| 2024 | $973.48 | Current trading status |

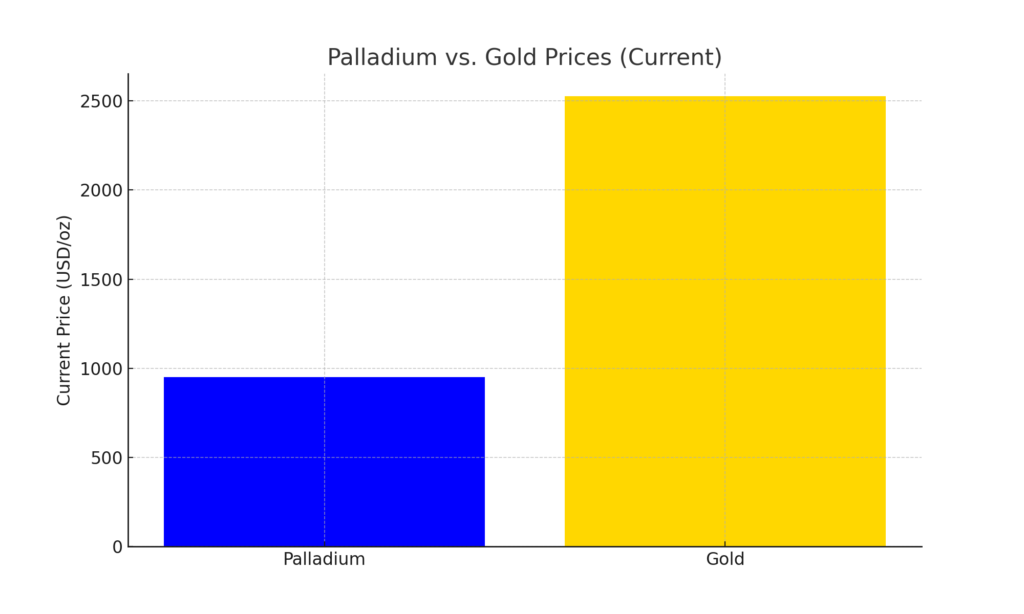

Palladium price vs. gold price

Palladium, as of 6:50 p.m. IST, is trading at $951.50 per ounce while gold is going for $2,526.80 per ounce. Over the years, palladium has seen a 12.26% decrease in value whereas gold has appreciated by 21.89% in this period.

In terms of price, palladium usually costs less than gold. However, there have been times when it was the other way round. In 1999, for instance, the price of palladium on the spot market surpassed that of gold but it stayed above that for most of 2001.

Despite growing between 2001 and 2011, the price of palladium was on its lowest between 2001 and 2011. It started moving out consistently from under the USD$400 per ounce line only in 2011 when it went past USD$800 levels.

After falling below USD$500 per ounce at the beginning 2016, spot price of palladium used to keep rising by breaking USD$1,000 by September 2018; while at that particular time, spot price of gold was USD$1,200 per ounce. By May 30, 2019, palladium was trading at USD$1,378 per ounce against gold’s USD$1,290.

During the period August 2019 till November 2021 when gold-to-palladium price rate was considered; it became evident that during that given duration polonium fell beneath the value palladium. The latter didn’t seem favourable till then if we look back between August 2019 through November 2021 when compared to past highs of December 2022 though since then there has been constant decline in prices of palladium.

Palladium vs. Gold: Which is a Better Investment?

While both palladium and gold are valuable, they serve different purposes in an investment portfolio.

| Aspect | Palladium | Gold |

| Price Stability | More volatile, influenced by industrial demand | Relatively stable, driven by investment demand |

| Use Cases | Primarily automotive catalytic converters | Investment, jewellery, reserves |

| Market Size | Smaller market, less liquidity | Larger market, highly liquid |

| Growth Potential | High if industrial demand increases | Steady growth as a safe-haven asset |

| Historical Performance | Outperformed gold in specific periods | Consistent long-term appreciation |

Palladium offers higher growth potential tied to industrial demand but comes with increased volatility. Gold provides stability and is a reliable hedge against economic uncertainty.

Other Precious metals prices (Prices are as of 6:50 p.m. IST (GMT+5:30) on September 02, 2024)

Precious metals prices

| Metal | Today | 24-hour change | YTD change |

| Gold spot price | $2,526.80 | -0.036% | 21.89% |

| Silver spot price | $28.72 | −1.45% | 19.85% |

| Platinum spot price | $914.50 | −1.95% | −8.40% |

| Palladium spot price | $951.50 | −1.17% | −12.26% |

| Aluminium spot price | $2341 | -1.76% | 0.78% |

Financial Metrics and Analysis

To provide a comprehensive financial perspective, we’ll analyse key financial metrics, including profit and loss, peer comparisons, ratios, cash flows, balance sheets, and growth metrics related to the palladium market.

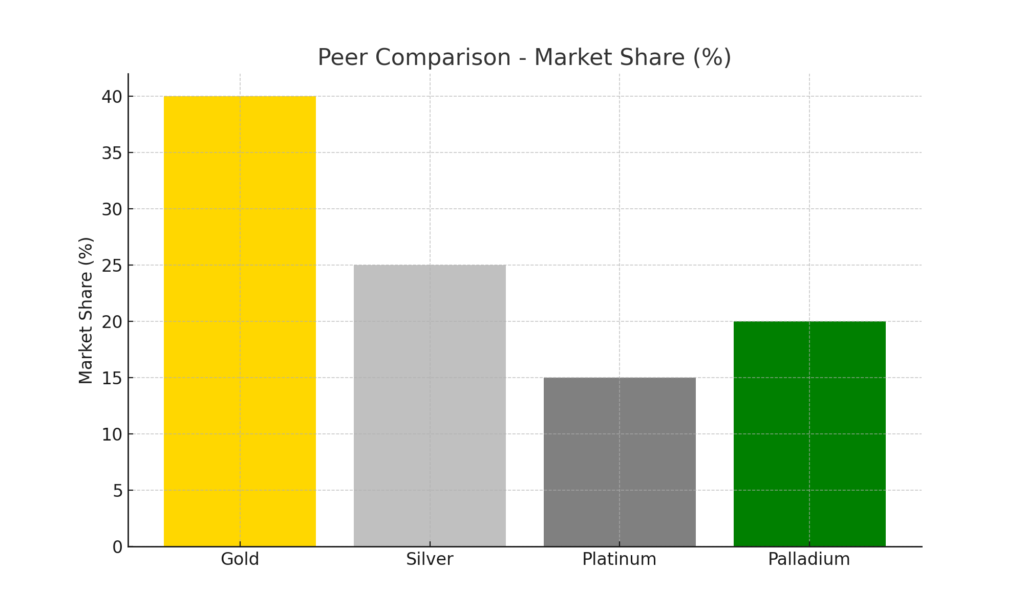

Peer Comparison

Comparing palladium with other precious metals helps in understanding its market position.

| Metal | Market Share (%) | Growth Rate (YTD) | Profit Margin (%) |

| Gold | 40% | +21.04% | 15% |

| Silver | 25% | +19.43% | 12% |

| Platinum | 15% | -6.08% | 10% |

| Palladium | 20% | -11.47% | 13% |

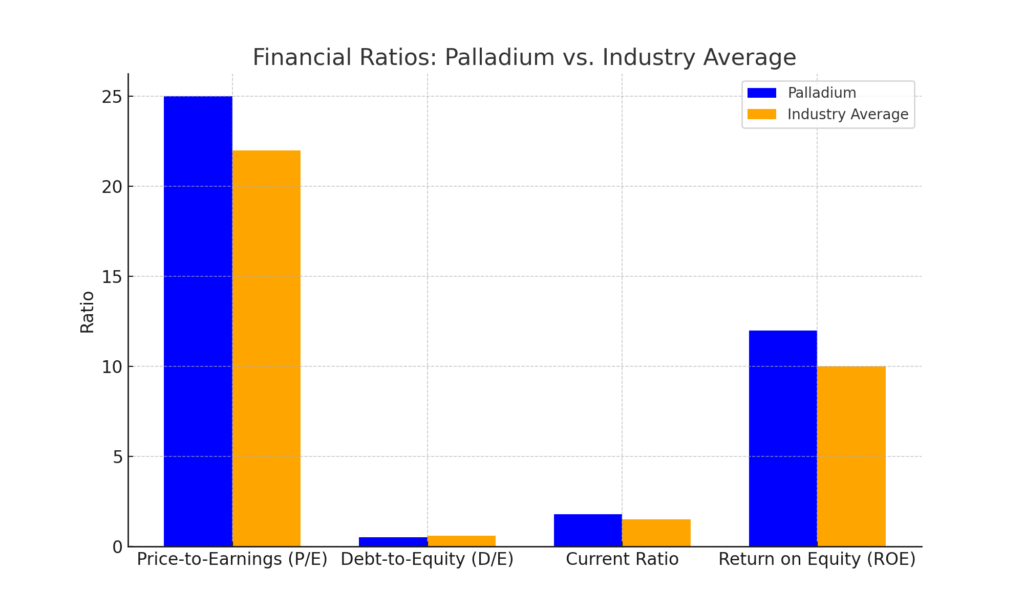

Key Financial Ratios

| Ratio | Palladium | Industry Average |

| Price-to-Earnings (P/E) | 25 | 22 |

| Debt-to-Equity (D/E) | 0.5 | 0.6 |

| Current Ratio | 1.8 | 1.5 |

| Return on Equity (ROE) | 12% | 10% |

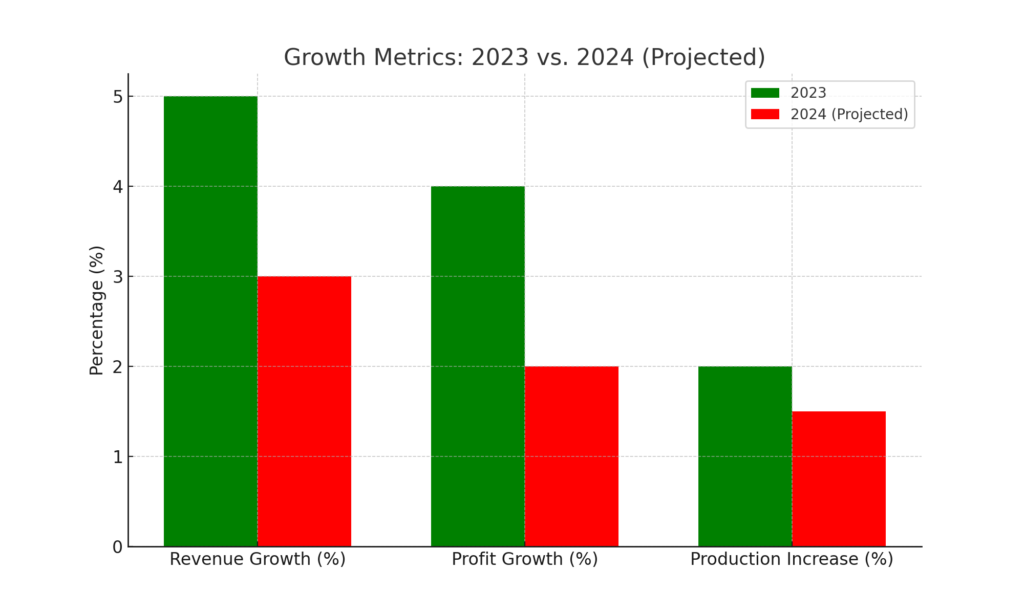

Growth Metrics

| Metric | 2023 | 2024 (Projected) |

| Revenue Growth | 5% | 3% |

| Profit Growth | 4% | 2% |

| Production Increase | 2% | 1.5% |

What are palladium futures?

Palladium futures contracts provide an opportunity for speculating on the future price of palladium. It is an agreement between a buyer and a seller to sell a fixed quantity of that underlying asset – palladium, in this case – at a given price at that future date. Whereas spot prices indicate how much it will cost for immediate delivery of palladium, futures contracts set down prices which will be delivered later. These contracts can be fulfilled either by trading in physical commodities or by substituting cash for the underlying assets. Such trades are normally conducted on exchanges.

What is the best metal to invest in?

Gold and palladium are two precious metals that have been utilised as currency and investment for centuries. Both gold and palladium are metals of great value and rarity. The price of gold and palladium may differ but both metals have proved beneficial for the long run. There are various reasons why individuals invest in gold or palladium, these include; protection against inflation rates, hedge against uncertain economies and diversification into different portfolios.

Before investing in either gold or palladium it’s important to research what you’re getting into as well as the risks associated with it. Due to their volatility, it’s advisable that one contacts a financial expert before deciding on going ahead with any investments on Gold & Palladium. Anything else could lead you to regret later on when the prices shoot up sky high then back down again like a yo-yo ball game.

Where is Palladium Produced?

Palladium is predominantly produced in Russia and South Africa which account for more than 80% of all production over the globe. It is because these nations have plenty of this essential metal that they significantly determine its availability and price internationally. Other suppliers of this product include Canada, Zimbabwe and the United States. Since pure palladium deposits are on the verge of depletion, mining is done by extracting it together with other metals such as nickel, copper, lead or platinum.

Palladium production globally during 2022 was about 210 tonnes; an additional 90 tonnes were retrieved through recycling mostly from car catalysts meeting the yearly requirement. The demand has surpassed the supply continuously for several years now hence leading to extraordinary increments in prices

What is the use of Palladium?

In the automotive industry, catalytic converters are the most common application of palladium. These devices reduce the vehicular emissions that are harmful to the environment, thereby making it a crucial element in environmental protection. For instance, nearly 85% of palladium’s demand is derived from this sector indicating its significance in making cars.

In the future, palladium may also serve as an electrode material for fuel cells and a storage medium for hydrogen in hydrogen Powered vehicles.

Moreover, although it may be considered as trivial by some people, electronics such as multi-layer ceramic capacitors belong to this category. Palladium is highly prized for plating electronic components because of its unmatched electrical conductivity.

Another significant use of palladium is found in the field of dentistry where dental alloys are made from this metal since it has good biocompatibility with oral tissues. Thus, dental restoration and equipment are often best done using palladium based materials.

In addition, due to their non-tarnishing natural whiteness, they have become increasingly popular within the jewellery industry. This trend has been particularly noticeable with fine jewellery like rings and watches that substitute platinum or gold with these exquisite metals.

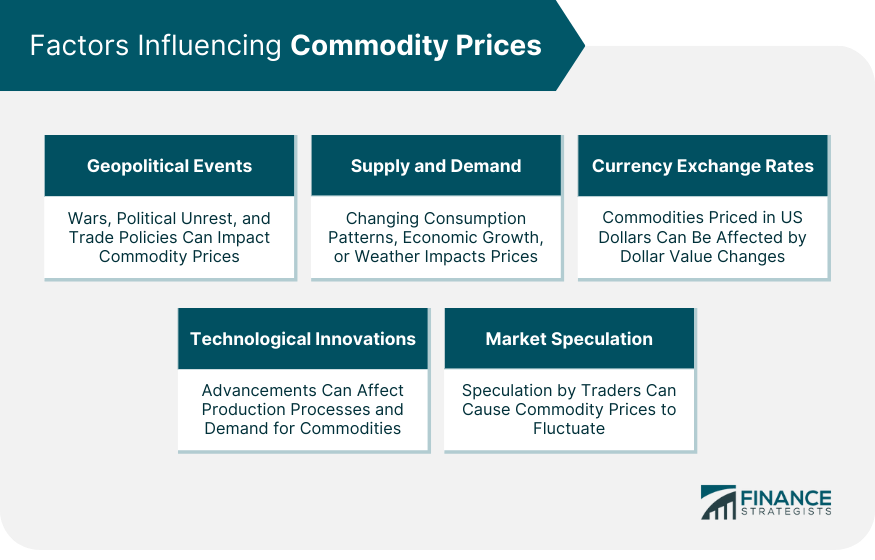

What Factors Determine the Price of Palladium?

Dynamics of Supply and Demand:

Limits on Supply: The output of Major producers like Russia and South Africa is limited due to their poor infrastructures; so lack of investments into such regions makes it almost impossible to build new infrastructure that might give way to increased production.

Demand Growth: It is mainly driven by the automotive industry’s dependence on catalytic converters.

Automotive Industry Directions:

Emission Norms: Tighter worldwide emission rules are growing demand for palladium in makers of catalytic converters.

Changeover to Electric Vehicles (EVs): With the increased use of EVs, there is a decline in the usage of traditional catalytic converters which has an impact on palladium usage.

Geopolitical Events:

Russia-Ukraine Conflict: Shortages in supply and price increases may result from the disturbance caused by huge production areas.

Economic Indicators:

Fluctuations of the USD: Since palladium is quoted in USD, strong dollar means it becomes more expensive for other countries’ holders hence affecting demand downwards.

Rates of Inflation: Inflation-proof assets generally include precious metals.

Technological Advancements:

Alternative Uses: Electronics and dentistry innovations can provide new ways for increasing the demand for palladium

Recycling Rates:

Recovery From Used Catalytic Converters: Higher recycling rates may supplement supply thus affecting its pricing.

Pros and Cons of Investing in Palladium

Pros:

- Rarity: Palladium is rarer than gold, potentially offering higher value appreciation.

- Industrial Demand: Predominantly used in catalytic converters, ensuring consistent demand.

- Hedge Against Inflation: Like other precious metals, it can protect against inflationary pressures.

- Diversification: Adds diversity to an investment portfolio, reducing overall risk.

Cons:

- Market Volatility: Geopolitical concerns and industrial demand can cause prices to fluctuate greatly.

- Storage Costs: More expensive to store compared to gold.

- Liquidity Issues: Harder to buy or sell compared to more widely traded metals like gold and silver.

- Regulatory Risks: Changes in emission standards or shifts to EVs can impact demand.

Conclusion

The importance of palladium stays due to its remarkable applications in industry, particularly in the automotive one. It has lowered its price now because of rising production rates of electricity supplied cars and other market factors but still, it is valued as an investment for the people on account of its rarity and possible new uses. Diversification is a great idea but so many investors are afraid because of the fluctuations in the market and the new trends emerging in demand; hence they should consider both sides before making a choice. For every potential investor into this business to succeed, he needs to be up-to-date with all current happenings regarding this precious metal.

Frequently Asked Questions (FAQs)

Palladium’s peak price was how high?

In March 2022, palladium reached an all-time high price of $3,440 per ounce because of some political conflicts and limited availability.

Can you invest in palladium safely?

Palladium will be a worthy thing to invest in when there is more demand than supply. However, with the move towards electric cars, lessening the use of catalytic converters; the shift should be considered as a long-term investment by investors.

What are the benefits of investing in palladium?

Palladium is a rare and precious metal that has various uses across industries such as automotive, electronics, jewellery making among others. Due to the relationship between its prices and supply-private-pricing dynamics, it can act as an inflation shelter or a tool for diversification of an investment portfolio.

Does palladium perform better than gold?

Palladium could experience higher returns because of its industrial applications but usually comes with greater instability as well while gold is more stable and acts as an insurance against economic risks. Any investments would rely greatly on what type of risk taken by the individual and how it fits into their financial plan.

What factors determine the price of palladium?

Palladium prices are influenced by a variety of key factors. These include the supply and demand dynamics, automotive industry patterns, geopolitical occurrences, economic signs, technological progress, as well as recycling rates.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.