Altria’s Dividend Legacy and Market Position

Altria Group (MO) has a significant place in dividend stocks. It is one of the largest and most well-known tobacco companies in the world. Due to this fact, it has been known to be the stock for all investors looking for steady income streams in a volatile market. Altria Group has an annualised forward dividend yield of 7.6%, which is much more than that of the consumer staples sector average at only 1.9%. Among such facts, it can be said that Altria’s stock makes a compelling case for those who need stability from their shares during times of uncertainty in financial markets.

Predictably enough, however, this has raised concerns among investors about the sustainability of Altria’s dividend as sales from cigarettes continue to decline and regulations are tightening by day in the tobacco industry. Nevertheless, recently Altria expanded its dividends indicating some confidence regarding its financial health but could it be enough to recommend purchase? Therefore let us review the company’s finances in detail before examining growth prospects and what experts suggest.

Table of Contents

Altria group (MO) Financial Performance and Growth Story

Revenue and Profit Trends

Altria’s revenue and profit trends show a divergent picture. Even though the company has kept its market share, it is still contending with tough challenges such as reduced cigarette usage in American households. The subsequent table depicts Altria’s recent financial results:

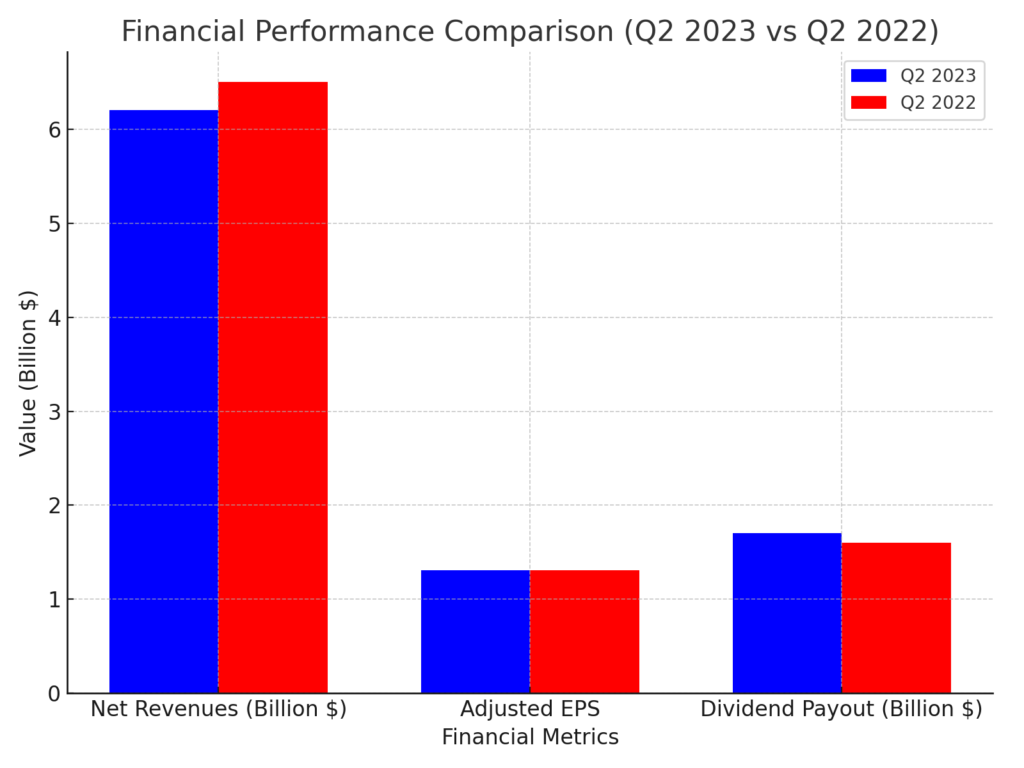

| Metric | Q2 2023 | Q2 2022 | % Change |

| Net Revenues | $6.2 billion | $6.5 billion | -4.6% |

| Adjusted EPS | $1.31 | $1.31 | 0% |

| Dividend Payout | $1.7 billion | $1.6 billion | +6.3% |

Amidst an alarming drop of 13% in the shipment volume of local cigarettes, Altria has been able to stabilise its Adjusted Earnings per Share (EPS) at $1.31. Therefore, this stability is necessary for investors to have faith given that revenue is declining in the main segment of smokable products.

Key Financial Ratios

To better understand Altria’s financial health, let’s examine some key financial ratios:

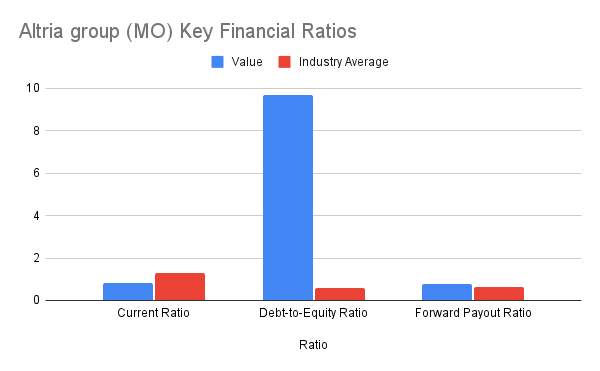

| Ratio | Value | Industry Average |

| Current Ratio | 0.8 | 1.3 |

| Debt-to-Equity Ratio | 9.7 | 0.6 |

| Forward Payout Ratio | 76.9% | 65% |

- Current Ratio: Altria’s current ratio of 0.8 indicates that it has less liquidity to cover short-term liabilities compared to the industry average.

- Debt-to-Equity Ratio: A high debt-to-equity ratio of 9.7 suggests that Altria is heavily leveraged, which could be a risk if revenue continues to decline.

- Forward Payout Ratio: The forward payout ratio of 76.9% is higher than the industry average, raising questions about the sustainability of its dividends.

Altria’s Strategic Initiatives to Sustain Dividends

Diversification into Alternative Products

Altria has acknowledged the struggles in their primary tobacco business and have initiated a transformation of their product assortment. One prominent thing they did is put in a huge investment into JUUL Labs that happens to be the biggest e-cigarette producer across the United States. All the same, this investment has faced scrutiny from regulators and some lawsuits which have led to big write downs.

Furthermore, besides venturing into electronic cigarettes, Altria moved into the cannabis sector by making an acquisition of 45% shareholding in Cronos Group that is based in Canada. Although this investment has not generated much profit, it paves way for Altria to take advantage of possible federal legalisation within the U.S because it would offer extra income.

Dividend Policy and Future Outlook

Through hardships, Altria has been able to reward its shareholders consistently. In recent times, the company’s quarterly dividend increased by 4.1% to $1.02 per share which is an addition of 59 with regard to dividend increase showing that they have become some of the Dividend Kings; this is to mean that such companies usually increase their dividends for a period of at least 50 years.

In the future, Altria will be increasing dividends in mid-single digit percentages every year until 2028, based on macroeconomic conditions and company performance as well. The analysts are projecting a 3.08% growth rate in EPSs for Altria in 2024 and another 3.9% by 2025 which render it a tempered optimism picture.

Peer Comparison: How Does Altria Stack Up?

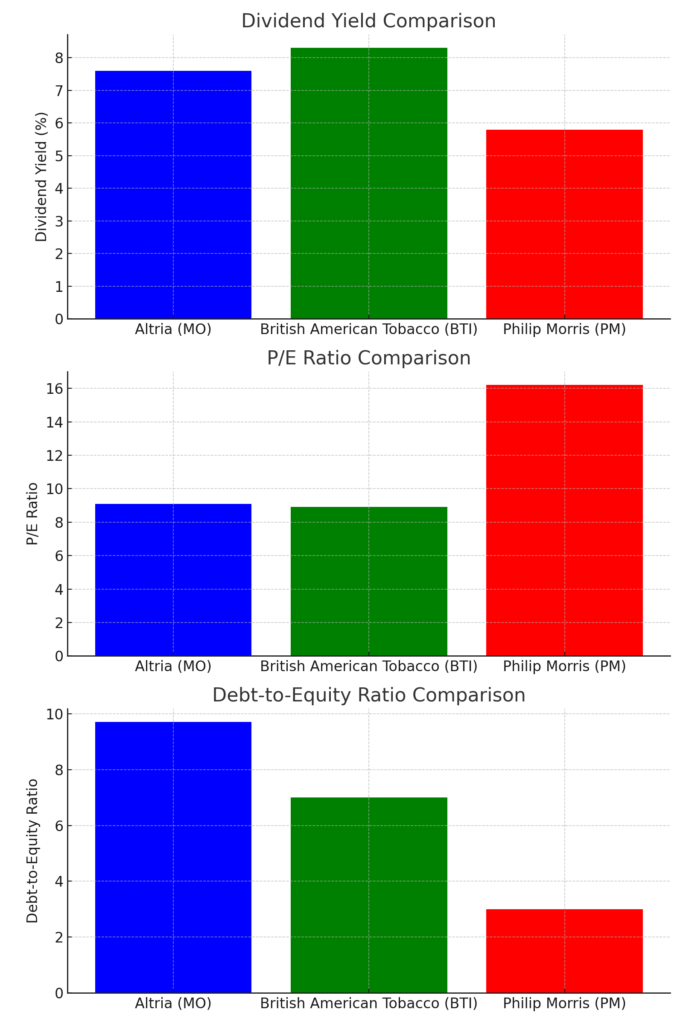

Comparing Altria to its peers provides additional context for evaluating its stock. The table below highlights key financial metrics and market positioning of Altria versus its competitors:

| Company | Market Cap | Dividend Yield | P/E Ratio | Debt-to-Equity Ratio |

| Altria (MO) | $92.35 billion | 7.6% | 9.1 | 9.7 |

| British American Tobacco (BTI) | $95 billion | 8.3% | 8.9 | 7.0 |

| Philip Morris International (PM) | $142 billion | 5.8% | 16.2 | 3.0 |

- Dividend Yield: Altria’s yield of 7.6% is competitive but slightly lower than British American Tobacco’s 8.3%.

- P/E Ratio: Altria’s price-to-earnings ratio (P/E) of 9.1 indicates it is valued more cheaply than Philip Morris but in line with British American Tobacco.

- Debt-to-Equity Ratio: Altria’s high debt-to-equity ratio remains a concern when compared to its peers, indicating higher financial risk.

Shareholding Pattern and Investor Sentiment

A combination of institutional and retail investors is shown by Altria’s shareholding structure whereby significant stock portions are held by institutions. The newest changes in shareholdings imply that some investors exercise caution while others still have faith in the long-term value of the company.

- Institutional Holdings: Approximately 60% of Altria’s shares are held by institutions, reflecting confidence in its dividend-paying ability.

- Retail Investors: The remaining 40% is held by retail investors, who are often attracted by the stock’s high yield.

Cash Flow and Balance Sheet Analysis

Altria’s ability to maintain its dividend payments can be evaluated through cash flow analysis. In spite of the diminished revenue situation, Altria’s cash flow from operating activities stays healthy enough for the firm to keep on giving out returns.

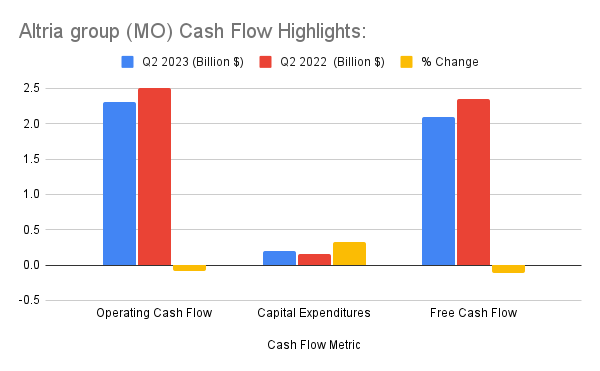

Cash Flow Highlights:

| Cash Flow Metric | Q2 2023 | Q2 2022 | % Change |

| Operating Cash Flow | $2.3 billion | $2.5 billion | -8% |

| Capital Expenditures | $0.2 billion | $0.15 billion | +33.3% |

| Free Cash Flow | $2.1 billion | $2.35 billion | -10.6% |

Altria’s operating cash flow of $2.3 billion in Q2 2023, while down 8% from the previous year, remains robust enough to cover its dividend obligations.

Balance Sheet Overview:

- Total Assets: $38 billion

- Total Liabilities: $33 billion

- Shareholders’ Equity: $5 billion

Altria’s balance sheet shows a heavily leveraged company with significant liabilities. However, its strong cash flow generation helps offset some of the risks associated with its high debt levels.

Conclusion: Is Altria a Buy?

Altria keeps on being a strong dividend stock, offering high yield and long-standing trustable payouts. However, one can’t overlook the difficulties that the tobacco industry has kept facing. The increased cigarette bans, as well as regulatory pressures together with high debts of the company results in risks which need attention from investors.

Altria’s positive strategic movement to alternatives in products and dedication to dividends is admirable; nonetheless, the general outlook remains clouded. Wall street experts are similarly confused, as most suggest ‘Hold’ for this specific stock. For Altria to continue existing as a dividend stock into the future it must successfully expand its product range while navigating the current decline in traditional tobacco items.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.