In the constantly changing realm of investments, a common query arises among prospective investors: “Is Tata Motors shares a wise long-term investment?” This inquiry applies not only to Tata Motor specifically, but also to the overall concept of long-term stock investments. Within this article, we will explore different facets of Tata Motor as an investment opportunity, analysing its recent achievements, potential, and the underlying elements that may impact your investment choices.

Table of Contents

Tata Motors Share: Weathering the Storm

Tata Motors shares have shown resilience in the face of market turbulence, particularly in recent times. Even as Wall Street experienced some instability, Tata Motors managed to hold its ground. Tata Motors’ move to raise the cost of its commercial cars served as the impetus for this achievement. The Tata Motors stock gained 14.50, or 2.31%, to Rs 641.05 on BSE on Friday.

This upward price revision marked the third such move by Tata Motors in 2023. The company decided to raise prices in its commercial vehicle segment by up to 3%, effective from October 1. Tata Motors attributed this decision to offsetting the residual impact of past input costs. It’s worth noting that this price hike encompasses the entire range of commercial vehicles offered by Tata Motors.

The consistent price increases are expected to have repercussions in the Indian commercial vehicle market, which had been factoring in normal volume growth for the fiscal year. Prior to this, Tata Motors had increased prices by 6.2% starting in January. The company gave a number of reasons for this increase, including the need to offset the impact of prior input cost increases, adhere to stricter emissions regulations, and roll out new features and technology.

The second phase of Bharat Stage 6 emission norms implemented by the government on April 1 posed additional challenges for auto manufacturers. These strict regulations included real-time driving emissions testing, which increased costs for the industry. Despite these challenges, Tata Motors maintained a positive outlook, with experts anticipating significant growth, especially in its commercial vehicle and Jaguar Land Rover businesses.

Expert Opinions on Tata Motors Share

It’s important to consider the opinions of industry experts when you are thinking about a long-term investment in Tata Motors.

Hemen Kapadia, Senior VP-Institutional Equity at KR Choksey Stocks & Securities, highlighted that Tata Motors has demonstrated a short-, medium-, and long-term uptrend. Furthermore, the stock’s recent performance, characterised by a 7-8-week time-price correction on the weekly chart, signals its intent to appreciate further. He suggested that, from a medium-term perspective, it’s prudent to buy Tata Motors on decline, with targets set at Rs 665 and Rs 690.

For existing investors, the future of Tata Motors looks promising. AK Prabhakar, Head of Research at IDBI Capital Markets, emphasised that Tata Motors remains an attractive buy due to the growth potential in its commercial vehicle and electric vehicle businesses. This optimistic outlook was echoed by Geojit, which recognized the company’s strong growth prospects, particularly driven by its commercial vehicle and Jaguar Land Rover operations.

In the short term, analysts Kushal Gupta and Varun Dubey from Zee Business expressed their endorsement of Tata Motors. They suggested considering the Rs 640 call option (‘at the money’) of Tata Motors for a target price of Rs 15, with a stop loss set at Rs 10.

Tata Motors share Stellar Q1 Performance

The performance of Tata Motors during the first quarter of the current fiscal year was exceptionally impressive. For the April–June quarter, the business recorded a consolidated net profit of Rs 3,090 crore, a considerable increase over the consolidated loss of Rs 4,987 crore during the same quarter the previous year. Significant rise was also seen in the quarterly revenue, which increased by 42.1% year over year to Rs 1,02,236 crore. The margins also saw a significant improvement, rising to 13.3%.

These results surpassed street estimates on multiple fronts. Zee Business research estimates that Tata Motors’ sales was Rs 1,01,500 crore, its margin was 11.4%, and its net profit for the quarter was projected to be Rs 2,000 crore. The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) for the quarter ending on June 30 amounted to Rs 13,559 crore, exceeding the estimated amount of Rs 11,550 crore projected by analysts.

Despite the expectation of a moderately inflationary environment in the near term, Tata Motors’ management expressed optimism about its demand prospects. The company’s favourable trajectory was evidenced by its outstanding performance in the first quarter.

Tata Motors Shares: A Historical Perspective

Tata Motors has a history of delivering substantial returns to its investors. Over eight years, the stock has witnessed remarkable growth, rising from 63 to over 640 rupees, marking almost a tenfold increase. However, the journey to this impressive growth was far from smooth.

The stock experienced its fair share of ups and downs. It navigated through periods of turbulence and sideways movements. During challenging times, articles and discussions emerged, especially when the company faced adverse results or challenges.

One significant challenge was the perception of high debt levels, which prompted concerns. Nevertheless, Tata Motors persevered with its vision and the support of its promoters, ultimately delivering a tenfold return on investment. This underscores an essential lesson in investing: multibagger stocks are not forged overnight but through the trials and tribulations that test the patience of investors.

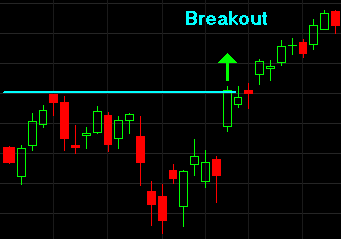

The recent multi-year breakout above 608 rupees raises questions about Tata Motors’ future trajectory. Speculation abounds about whether the stock will continue its upward journey to reach 2000 rupees. While such projections are appealing, it is critical to analyse the elements that influence the company’s success.

Investors should remain mindful that significant price movements may not occur overnight. Understanding the company’s strategies, operations, and the rationale behind its actions is crucial. To get a full picture of Tata Motors future, we need to go further into its business areas, income sources, and development ambitions.

Tata Motors share: A Multifaceted Auto Giant

Tata Motors is a versatile player in the automotive industry. It claims the top spot in commercial vehicles, making it a prominent force in this segment. Furthermore, Tata Motors ranks third in passenger vehicles, and its presence in the electric vehicle sector, which is just getting started in India, has already made considerable achievements.

The legendary Jaguar and Land Rover brands are among its crown jewels, accounting for a sizable chunk of company income.

The company’s offerings extend beyond vehicles to encompass motor vehicle financing, further diversifying its operations.

According to Tata Motors revenue breakdown, Jaguar and Land Rover generate around 64% of its revenue, commercial vehicles generate 21%, passenger vehicles generate 14%, and vehicle financing generates the remaining 1%. Given the potential of the EV industry in the next year, the addition of electric cars in the passenger vehicle category adds an intriguing dimension to the business.

Tata Motors share: Segment-Wise Growth

Analysing the growth in revenue across different segments offers valuable insights into Tata Motors’ trajectory. In the financial year 2023, the revenue of Jaguar Land Rover witnessed a robust 18.73% growth compared to the previous year. Commercial vehicle revenue experienced a remarkable 35.43% increase, while passenger vehicle revenue, which now includes electric vehicles, soared by 51.88%. The vehicle financing business, on the other hand, saw modest growth of 0.21%.

This detailed breakdown underscores the pivotal role that the electric vehicle segment is expected to play in Tata Motors’ growth story. Although EV’s have yet to achieve their full potential, their impact on the company’s income is already visible.

Global Presence

With operations in 125 nations including North America, Europe, the UK, China, and India, Tata Motors has a truly worldwide reach. Tata motors have 15 production facilities in India, 3 research and development facilities in the United Kingdom, 5 production facilities and 3 R&D facilities in Europe, 2 production facilities and 1 R&D facility in North America, and 1 manufacturing facility in China, 33% of the revenue at these locations comes from India, 16% from the USA, 10% from the UK, 12% from the EU, 14% from China, and 15% from other areas, according to the revenue distribution across these locations.

Tata Motors’ global reach and diversified manufacturing sites signify its strong international presence and its ability to cater to various markets.

Is it Good to Buy Tata Motors Share for Long Term future investment

The future of any automotive company can be assessed by examining its order book and capital expenditures. Tata Motors has ambitious investment plans, with a commitment to invest 38,000 crores in the fiscal year 2023-2024. These funds will be allocated to launch new products and adopt cutting-edge technology.

The business plans to launch over ten new passenger cars and over forty new commercial vehicles. Also Tata Motors has gotten pre-orders for 200,000 Jaguar Land Rover vehicles. It is noteworthy that it has orders from the Bengaluru Metropolitan Transport Corporation for 921 buses and the Delhi Transport Corporation for 1,500 vehicles.

Tata Motors’ investment in innovation and expansion showcases its commitment to future growth and its ability to meet evolving market demands.

Addressing Challenges for Tata Motors share

The semiconductor chip shortage, which significantly impacted Tata Motors operations, highlights the importance of addressing challenges. Shortages of chips forced the firm to stop manufacturing, raising doubts about its long-term sustainability.

Tata Motors adopted a multi-faceted approach to face this issue. Firstly, it sought to implement technology that decreases the reliance

on chips. Secondly, the company embarked on a process of replacing outdated chips with newer alternatives. Lastly, it formed strategic partnerships with chip suppliers to ensure a stable chip supply.

This approach underscores Tata Motors’ determination to overcome obstacles and continue its growth trajectory.

Tata Motors share: Financial Resilience

Tata Motors has not only weathered recent challenges but also demonstrated financial resilience. In March 2023, the company went from a net loss of 11,309 crores to a net profit of 2,690 crores.

This shift from loss to profit underscores the company’s ability to adapt and thrive.

Year-over-year quarterly sales growth of 35% and profit growth of 563% highlight Tata Motors’ robust financial performance. The company’s current return on equity (ROE) stands at 5.62%, with a return on capital employed (ROCE) of 6.14%. While these ratios may further improve, the company already exhibits financial strength, with a cash cycle of -45 days, meaning it receives cash in advance.

Tata Motors debt-to-equity ratio is 2.96, indicating a relatively high level of debt. However, the company maintains an interest coverage ratio of 1.11, suggesting it generates more revenue to service its debt obligations.

Tata Motors share: Valuation and Outlook

Tata Motors current price-to-earnings (PE) ratio stands at 87.70, while the industry PE ratio is 90.5. The price/earnings to growth (PEG) ratio is 1.12, reflecting a balanced valuation. Additionally, the price-to-book value for Tata Motors is 4.55, compared to the industry’s 5.06, suggesting that the stock offers a favorable valuation proposition.

Despite the attractive valuation, it’s prudent to approach investments in Tata Motors with diversification in mind. Market dynamics can introduce volatility, and a disciplined approach to investment can help navigate potential corrections in the stock price.

Tata Motors share: The Conclusion

The answer to the important question, Is it Good to Buy Tata Motors Share for Long Term? is found in a careful analysis of the performance, prospects, and overall investing environment of the business.

Tata Motors has demonstrated resilience in the face of challenges and continues to invest in innovation and expansion.

While the stock has delivered remarkable returns, investors should be prepared for occasional corrections and maintain a long-term perspective. When it comes to investing, perseverance and a deep knowledge of the fundamentals may pay off handsomely, Tata Motors seems to be headed in the right direction, and a long-term investment in the business might result in significant profits.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.