6 Best Loans for Bad Credit of 2024: It can feel like trying to find your way through a labyrinth when you’re searching for personal loans with poor credit, but do not fret – we do most of the difficult jobs for you. There are lenders that can help you even if your credit rating is below par whether it’s in respect of stresses like medical bills or car repairs, high-interest debt refinancing, or consolidating payments. This October, we will take a close look at some of the leading bad credit loans around in terms of fees, interest rates and flexible repayment plans.

Table of Contents

6 Best Loans for Bad Credit of 2024

1.6 Best Loans for Bad Credit of 2024: OneMain Financial Personal Loans

Best for Flexible Terms

OneMain Financial stands out for its flexibility in repayment terms and its willingness to work with borrowers who have less-than-stellar credit. Here’s what you need to know:

| Feature | Details |

| APR | 18.00% to 35.99% |

| Loan Purpose | Debt consolidation, major expenses, emergency costs |

| Loan Amounts | $1,500 to $20,000 |

| Terms | 24 to 60 Months |

| Credit Needed | Poor/Fair |

| Origination Fee | $25 to $500 or 1% to 10% (varies by state) |

| Early Payoff Penalty | None |

| Late Fee | Up to $30 or 15% (varies by state) |

Pros:

- Approves applicants with bad or fair credit

- No early payoff fees

- Quick funding (1-2 business days)

- Option to apply for a secured loan for better rates

Cons:

- High origination fees

- High-interest rates

Who’s This For?

If you’re looking for a lender that offers flexibility in repayment terms without requiring a minimum credit score, OneMain Financial is a strong option. Plus, you can see if you prequalify without a hard credit check, which won’t affect your credit score.

2. 6 Best Loans for Bad Credit of 2024: Avant Personal Loans

Best for Quick Funding

When you’re in a pinch and need cash fast, Avant might be your best bet.

| Feature | Details |

| APR | 9.95% to 35.99% |

| Loan Purpose | Debt consolidation, major expenses, home improvements |

| Loan Amounts | $2,000 to $35,000 |

| Terms | 24 to 60 Months |

| Credit Needed | Poor/Fair |

| Origination Fee | Up to 9.99% |

| Early Payoff Penalty | None |

| Late Fee | Up to $25 after a 10-day grace period |

Pros:

- Quick funding (often by the next day)

- Late payment grace period of 10 days

- Soft credit check to pre-qualify

Cons:

- High-interest rates, capping at 35.99% APR

- No direct payments to creditors for debt consolidation

Who’s This For?

Avant is ideal if you need money quickly and have a credit score in the range of 600 to 700. The lender considers both your credit score and income, making it accessible even for those with less-than-perfect credit.

3. 6 Best Loans for Bad Credit of 2024: LendingPoint Personal Loans

Best for Fast Approval

LendingPoint offers a quick and easy application process, with same-day approval in many cases.

| Feature | Details |

| APR | 7.99% to 35.99% |

| Loan Purpose | debt relief, getting married, fixing cars, remodelling homes, and more |

| Loan Amounts | $1,000 to $36,500 |

| Terms | 24 to 72 Months |

| Credit Needed | Poor/Fair |

| Origination Fee | Up to 10% (varies by state) |

| Early Payoff Penalty | None |

| Late Fee | None currently, but up to $30 in some states |

Pros:

- Fast application with same-day approval

- Soft inquiry to prequalify

- No early payoff fees

Cons:

- Not available in Nevada or West Virginia

- Must have a Social Security number

Who’s This For?

LendingPoint is a great option if you’re looking for a loan with a decent APR and fast approval. While it doesn’t have the lowest APRs, it’s still competitive, starting at 7.99%. It’s also flexible with loan terms, making it suitable for various financial needs.

4. 6 Best Loans for Bad Credit of 2024: Upstart Personal Loans

Best for People Without a Credit History

If your credit history is sparse or nonexistent, Upstart might be the way to go.

| Feature | Details |

| APR | 7.8% to 35.99% |

| Loan Purpose | Debt consolidation, credit card refinancing, wedding, moving, or medical |

| Loan Amounts | $1,000 to $50,000 |

| Terms | 36 and 60 Months |

| Credit Needed | 300 or no credit score |

| Origination Fee | 0% to 12% |

| Early Payoff Penalty | None |

| Late Fee | 5% of the past due amount or $15, whichever is greater |

Pros:

- Open to borrowers with fair credit (minimum 300 score)

- Accepts applicants without a credit score

- Fast funding (next business day)

Cons:

- High late fees

- Origination fee up to 12%

Who’s This For? Upstart is ideal for borrowers who are just starting to build their credit or have a limited credit history. It looks beyond credit scores, considering factors like education and employment, making it more accessible for those with unconventional financial backgrounds.

5. 6 Best Loans for Bad Credit of 2024: BadCreditLoans.com Best for Loan Variety

| Feature | Details |

| APR | Varies by lender |

| Loan Purpose | Debt consolidation, medical bills, auto repairs, and more |

| Loan Amounts | $500 to $10,000 |

| Terms | 3 to 60 Months |

| Credit Needed | Poor to Fair |

| Origination Fee | Varies by lender |

| Early Payoff Penalty | None |

| Late Fee | Varies by lender |

Pros:

- Connects borrowers with a network of lenders

- provides a large selection of lending terms and quantities.

- No fee for using the service

Cons:

- APR and fees can vary significantly

- Approval criteria depend on individual lenders

Who’s This For?

BadCreditLoans.com is an excellent option for those seeking a variety of loan choices. By connecting with multiple lenders, borrowers can compare terms and choose the best offer for their needs.

6. 6 Best Loans for Bad Credit of 2024: NetCredit Personal Loans Best for Flexible Repayment Options

| Feature | Details |

| APR | 19.99% to 155% |

| Loan Purpose | Debt consolidation, major expenses, emergency costs |

| Loan Amounts | $1,000 to $10,000 (may vary by state) |

| Terms | 6 to 60 Months |

| Credit Needed | Poor to Fair |

| Origination Fee | None |

| Early Payoff Penalty | None |

| Late Fee | May apply, varies by state |

Pros:

- Allows customers to change payment dates

- Offers a personal loan calculator to estimate payments

- No early payoff fees

Cons:

- High interest rates

- Limited to certain states

Who’s This For?

NetCredit is best for those who want flexibility in repayment schedules and are looking for a lender that allows adjustments to payment dates.

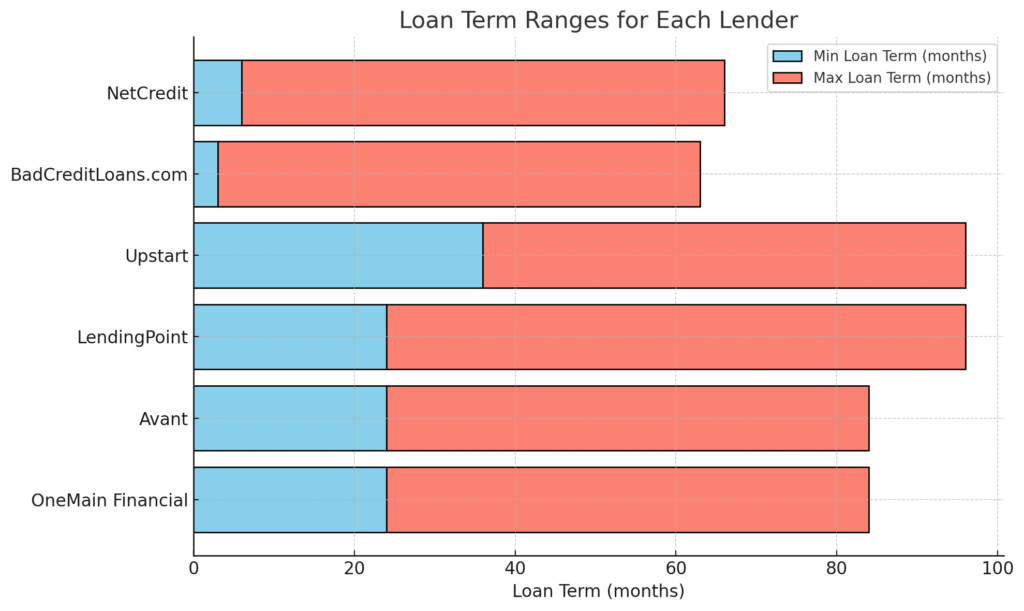

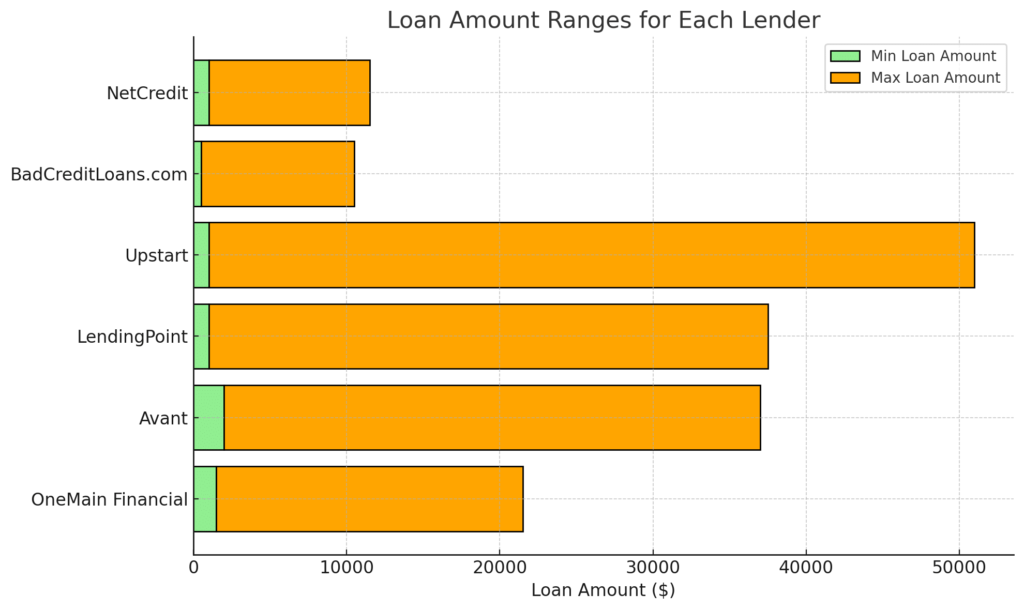

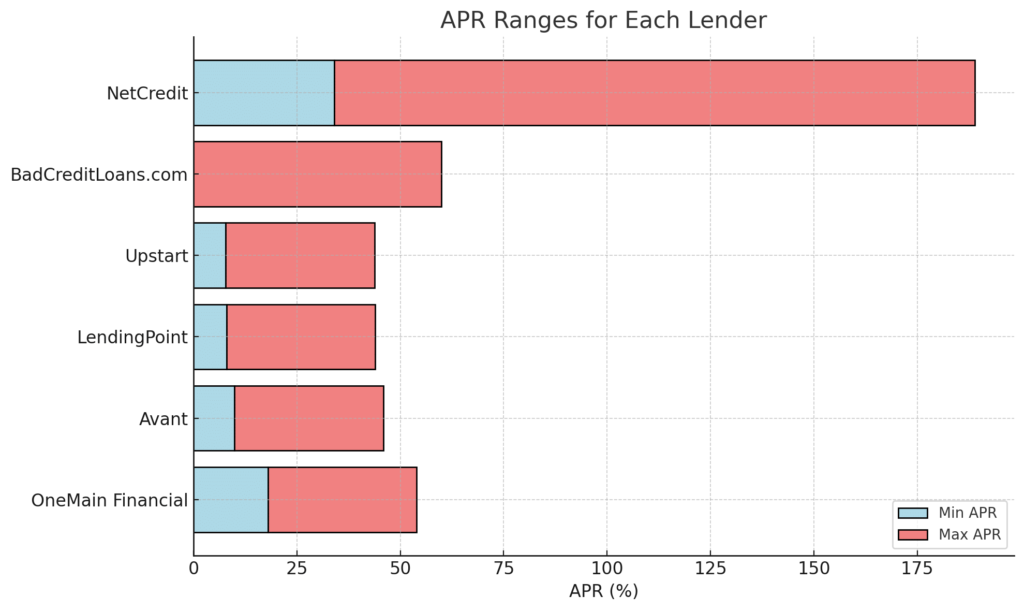

Table and graph: Overview of the 6 Best Personal Loans for Bad Credit

| Lender | APR Range | Loan Amounts | Loan Terms | Origination Fee | Credit Needed | Early Payoff Penalty |

| OneMain Financial | 18.00% – 35.99% | $1,500 – $20,000 | 24 – 60 months | $25 to $500 or 1% – 10% | Poor/Fair | None |

| Avant | 9.95% – 35.99% | $2,000 – $35,000 | 24 – 60 months | Up to 9.99% | Poor/Fair | None |

| LendingPoint | 7.99% – 35.99% | $1,000 – $36,500 | 24 – 72 months | Up to 10% | Poor/Fair | None |

| Upstart | 7.8% – 35.99% | $1,000 – $50,000 | 36 – 60 months | 0% – 12% | Poor/Fair or None | None |

| BadCreditLoans.com | Varies | $500 – $10,000 | 3 – 60 months | Varies by lender | Poor/Fair | None |

| NetCredit | 34.00% – 155.00% | $1,000 – $10,500 | 6 – 60 months | Varies by state | Poor/Fair | None |

What is a Bad Credit Score?

Before diving into a loan, it’s essential to understand where your credit stands. Here’s how lenders classify credit scores:

| FICO Score | Classification |

| 300 to 579 | Very Poor |

| 580 to 669 | Fair |

| 670 to 739 | Good |

| 740 to 799 | Very Good |

| 800 to 850 | Excellent |

| VantageScore | Classification |

| 300 to 499 | Very Poor |

| 500 to 600 | Poor |

| 601 to 660 | Fair |

| 661 to 780 | Good |

| 781 to 850 | Excellent |

Tips to Qualify for a Bad Credit Loan

Getting a loan with poor credit can be difficult, but there are ways to increase your chances:

- Check Your Credit: Know your score and dispute any errors on your report.

- Pre-Qualify: See if you’re likely to be approved without a hard credit check.

- Use a Co-Signer: A co-signer with good credit can improve your approval chances.

- Add Collateral: Consider a secured loan to access better terms.

- Include Additional Income: Adding non-employment income can enhance your application.

Alternatives to High-Interest Loans

Recommending some variations for bad credit loans:

- Peer-to-Peer Financing: Individuals lend money instead of banking institutions.

- Life Insurance Policy Loan: Get a loan using the cash value of your life assurance policy.

- 401(k) Loan: Request for money from your employer-sponsored retirement account.

Pros and Cons of Bad Credit Loans

Gaining insight into the merits and demerits may assist you in making a knowledgeable choice:

- Benefits:

Funds can be accessed in times of emergencies

A chance to increase ratings of a credit report if payment is done punctually

There are alternative ways available like having someone else sign the loan agreement which will lead to good conditions - Disadvantages:

Though, it has higher interest rates

Loans may just be few Therefore reasons may not make them viable for everybody

Although this option is risky such that it can lead to temporary decline in your score as far as hard inquiries are concerned

Conclusion

Nevertheless, there are lenders who provide easy approaches for getting a personal loan internet with bad credit. When looking for a loan to meet your financial needs without undue pressure, it is essential that you know about the current state of your credit as well as go through different types of loans and alternatives. Before applying for any personal loan always look at the interest rates carefully and ensure you take the one that fits within your repayment capabilities.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.