Ford’s EV Strategy: Ford Motor Company recently made an important announcement regarding its EV strategy that may cost it around $1.9 billion dollars. This shift suggests they will be cancelling plans for a massive electric SUV with three rows and instead turn their attention towards smaller, less expensive EVs and hybrids. The change has caused some discussion among investors as well as industry analysts concerning Ford’s future in this domain vis-a-vis the automotive market as a whole.

Table of Contents

1. Understanding Ford’s Strategic Shift in EV Focus

Ford’s decision to pivot its EV strategy is driven by several factors. Historically, Ford’s profit margins have been bolstered by large trucks and SUVs, particularly in the U.S. market. However, the EV landscape presents different dynamics. According to Marin Gjaja, Ford’s Chief Operating Officer for its Model e EV unit, “the highest adoption rates for electric vehicles will be in the affordable segment on the lower size-end of the range.” This shift in focus reflects Ford’s belief that smaller, more affordable EVs will drive higher volumes and profitability.

Key Points of the Ford’s EV Strategy:

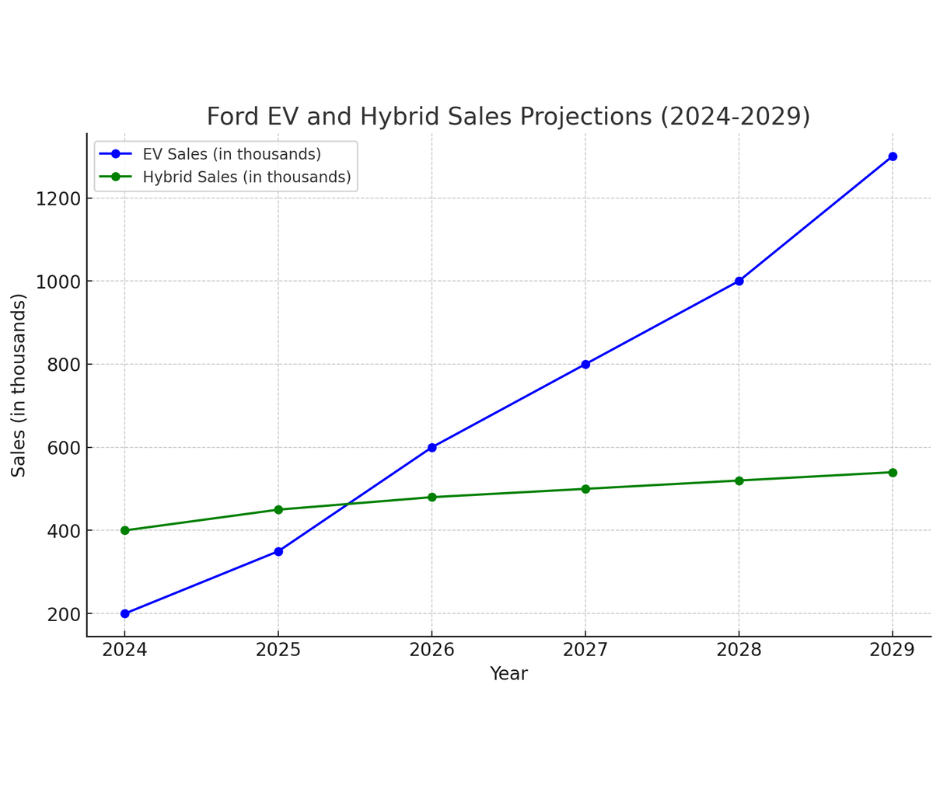

- Shift from Large SUVs to Smaller, Affordable EVs: Ford intends to concentrate on more reasonably priced, smaller cars, aiming to capture the market that is predicted to experience the fastest rates of EV adoption.

- Expansion of Hybrid Models:The business intends to increase its EV offerings while complying with increasingly stringent fuel economy rules by utilising its expanding array of hybrid models.

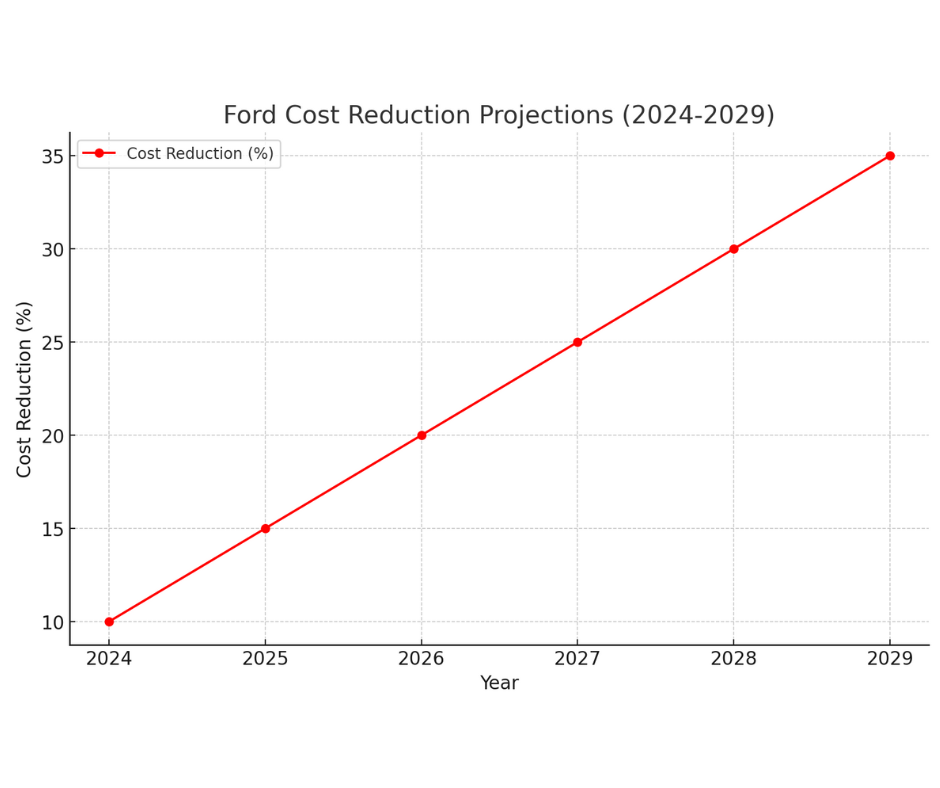

- Cost Implications: Ford will have to pay up to $1.9 billion for this strategy change, which includes a $400 million write-down of its manufacturing assets and up to $1.5 billion in additional costs.

2. Financial Impact: Ford’s $1.9 Billion Gamble

The cancellation of Ford’s big electric SUV with three rows of seating and reallocation of resources will be a huge financial blow for the company. In this part, we will elaborate on the finances involved in this case, identifying likely anticipated costs and possible write-offs.

Table 1: Breakdown of Ford’s $1.9 Billion Cost

| Expense Category | Estimated Cost ($ Billion) |

| Write-Down of Manufacturing Assets | 0.4 |

| Additional Expenses | 1.5 |

| Total | 1.9 |

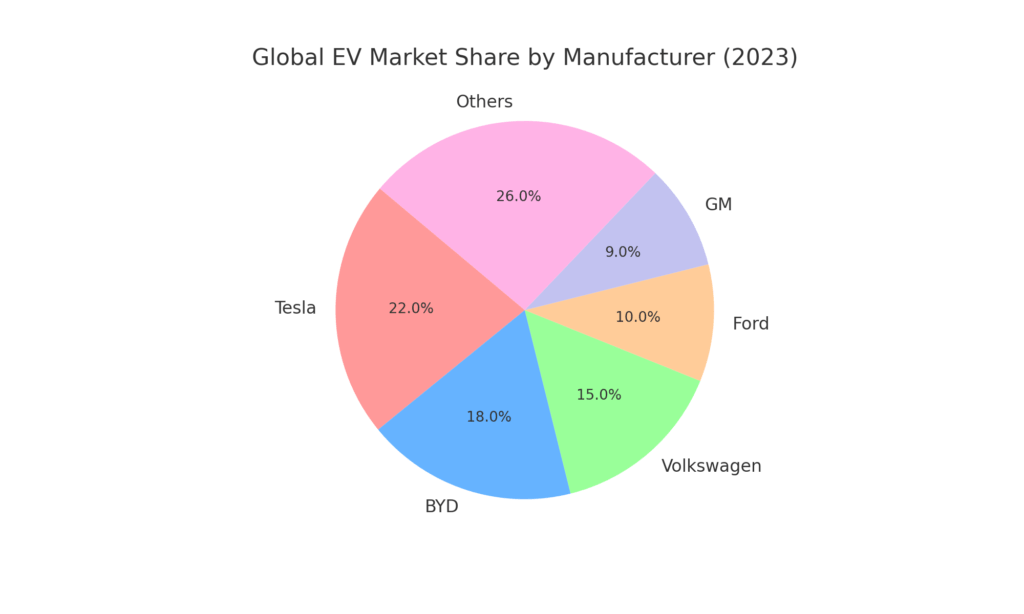

Although this decision may appear to be an expensive one, Ford’s intention is to set up a more financially efficient and profitable EV enterprise. With the aim of entering into competition with Chinese brands such as BYD which are growing at a fast pace within Europe and other regions of the world, Ford has decided to concentrate on producing smaller and cheaper cars.

3. Rationale Behind the Shift: Competing with Chinese Automakers

Ford’s decision to put emphasis on smaller electric vehicles is among the results of quick expansion of Chinese car manufacturers into the global market. There are several companies such as BYD that have gradually broken out of China’s borders, spreading their tentacles to different regions in Europe and other places with cheap but durable electric vehicles. This move by Ford is a direct response to these rivalries.

As pointed out by Jim Farley, who is CEO for Ford Company, bigger automobiles usually attract better margins in case of cars using petrol/diesel engines (ICE), but the opposite applies for electric automobiles because of their weight and battery pack costs. To this end, it is clear that Ford’s focus has been on smaller inexpensive electric vehicles as opposed to larger power-hungry ones like proposed three-row SUVs.

Global EV Market Share by Manufacturer (2023)

4. Ford’s EV Strategy shift : What’sComing Next?

With the shift in strategy, Ford has outlined a revised EV lineup plan:

- 2026: Introduction of a new electric commercial van.

- 2027: Launch of a midsize electric pickup and the next-generation “T3” full-size electric pickup.

Ford has long been known for its success in key market sectors such as commercial vehicles as well as passenger trucks, therefore these models are aimed at these target areas. It hopes that by doing so it can utilise its competitive success factors and create an economically viable enterprise based on electric vehicle technology.

Table 2: Ford’s Revised EV Product Roadmap

| Year | Vehicle Type | Description |

| 2026 | Electric Commercial Van | Targeting fleet customers and small businesses |

| 2027 | Midsize Electric Pickup | New platform developed by a specialised team |

| 2027 | Next-Generation “T3” Full-Size Pickup | Delayed launch for strategic repositioning |

5. The Role of Hybrids in Ford’s Future Strategy

To add to the change in EV strategy, Ford intends to increase carbonate vehicles. It is anticipated that in 2030, Ford will be providing hybrid choices throughout its whole North American series including explorers and expeditions which are examples of mainstream SUVs with three rows. This initiative also aligns with general trends in other industrial categories as well as government regulations mandating vehicle manufacturers to cut down their emissions and improve on fuel consumption.

John Lawler commented on Ford’s CFO indicating that the automaker would rework its capital deployment lowering EV share from 40% down to 30%. The move represents an even more pragmatic approach to electrification for Ford that has given rise to hybrids as a major dimension of their strategy.

6. Industry Reactions: What Analysts Are Saying

Ford’s strategic shift has received a mixed response from analysts and industry experts. For instance, some like those from Bank of America consider the move as a significant transformation to enhance profitability and capital use.

They think that concentrating on hybrids as well as smaller electric vehicles will considerably help Ford tap into rising demand and at the same time exploit its strengths.

Conversely Wells Fargo analysts relay concerns about Ford’s recurrent changes in strategy and how it might fare amid a fast evolving EV market today.

The decision by Ford to scrap its three-row electric SUV innovation plan together with the postponement of launching new electric cars exhibit price pressures besides other risks in the current automotive industry overall.

Table 3: Analyst Reactions to Ford’s EV Strategy Shift

| Analyst Group | Reaction Summary |

| Bank of America | Positive on profitability improvement and capital efficiency. |

| Wells Fargo | Concerned about strategy shifts and market risks. |

| Bernstein | Cautiously optimistic but notes slow implementation of battery localization plans. |

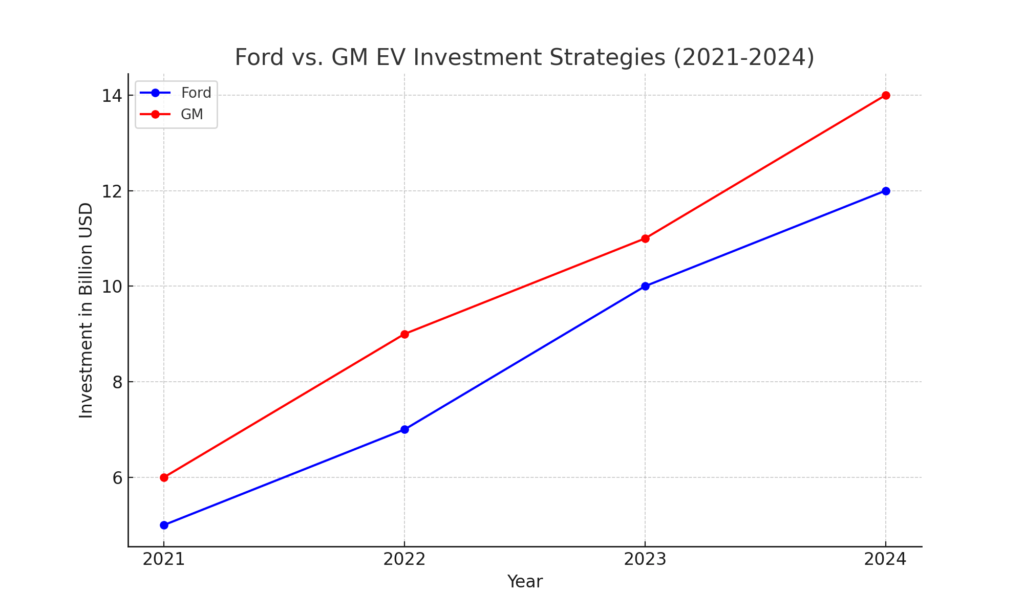

7. Ford vs. GM: Divergent Paths in the EV Race

Even though Ford is cutting back its electric vehicle plans, its biggest rival in the industry, which is General Motors (GM), is taking a different path. GM has maintained its aggressive approach towards EVs investing heavily on a specific EV platform and battery technology. At present, GM’s electric vehicles consist of many large all-electric models like the Hummer SUV and the fully electric Cadillac Escalade.

There is a remarkable distinction between the strategies of Ford and that of GM, which illuminates how automotive manufacturers are responding to challenges of demand in the market. The future of cars without any petrol would be taken over exclusively by GM; however, for Ford it will require more time as they put an emphasis on hybrids amid EVs.

8. Investor Implications: What This Means for Ford Shareholders

So for financiers Ford’s decision offers both chances as well as dangers. Obviously in connection with the latter laterally it may be an advantage for Ford to become an important player in this field considering small and not so dear electric vehicles (EVs) and hybrids are gaining higher approval from different groups including those who control the circulation of money or tenders, even if there are people who find them very expensive compared to conventional cars.

But this transition costs $1.9 billion and because of the difficulties currently encountered in the market for electric vehicles (EV) “jeopardises success today’s financial performance” (Smith, 2010). Furthermore, it happens that since release of news about these new measures Ford’s shares had slightly improved which points out investors started feeling hope again towards their business future.

9. Strategic Partnerships and Technology Investments

To bolster its new strategic direction, Ford is likely to explore further partnerships and technological investments that align with its revised focus:

- Collaborations with Battery Suppliers: Ford may seek to deepen collaborations with battery suppliers to secure access to more affordable and efficient battery technologies. Thus, it is expected that Ford can invest in new battery chemistries or solid-state batteries aiming to reduce vehicle production costs and make them efficient hence setting standards for their range and performance such as Electric Vehicles in order that they may compete favourably in low-cost categories.

- Technology and Software Investments: It’s likely that Ford will put money into improving its in-vehicle software and connectivity features as the automotive industry places an emphasis on software and digital services for cars. Improving the performance of smaller EV models through advanced driver-assistance systems (ADAS), infotainment, and over-the-air (OTA) update capabilities may help set them apart from others within a saturated market.

10. Global Market Considerations and Expansion Plans

Despite its primary concentration on the North American market, Ford must however be cognizant of its global reach and varying circumstances in other nations:

- European and Asian Market Dynamics: Ford may get better market share due to its changing course which is more appealing in Europe where small cars and hybrids are already well established. In Indonesia or Southeast Asia for example, attention given to smaller as well as inexpensive cars makes it possible for new growth opportunities.

- Regional Regulations Need Adaptation: Various markets contain diverse regulatory requirements as well as incentives for EVs within them I order to expand worldwide; hence they should tailor their line-ups as per local laws or taste preferences. For instance, China’s fierce competition is going to depend on how well the company adapts within this country.

11. Customer Experience and Brand Perception

To move in the right direction, Ford’s newly revised approach will focus on keeping a strong customer experience and brand image:

- Generating consumer confidence in electric vehicles: There is a need for Ford to create trust among individuals who are unfamiliar with electric vehicles (EVs). This involves giving much information about what it means to own such cars. This involves educating them on what it means to own such vehicles in terms of benefits deriving from that kind of ownership, ensuring reliable after-sale services and setting up an extensive charging system.

- Using Ford’s Legacy: With years spent working in the automotive industry, Ford has established for itself a certain reputation which it can use to persuade potential buyers of its novel EVs & hybrids about their quality and dependability. Streamlined communication concerning innovation without loss of faith and allegiance to her conventional clientele would play a major role too.

12. The Road Ahead: Strategic Flexibility and Risk Management

The recent changes in Ford signify an understanding that it is necessary to have flexible strategies and manage risks in a dynamic market environment:

- Close monitoring of the market responses: Ford must keep tabs on how well consumers receive its new smaller electric vehicles and hybrids. There should also be a readiness for further adjustments including changing prices, improving product features or fast-tracking new models if there are any market fluctuations.

- Short-term costs compared with long-term objectives: Although this strategy shift comes with high immediate financial implications, in order for Ford to attain a sustainable and profitable EV business within desired timelines, it must weigh such expenses against its long-range plans. This will shape the firm’s success or lack thereof amidst other players in the highly competitive electric vehicle industry.

- Responding to competitive pressures: As rivals like Tesla, GM and other multinational vehicle manufacturers aggressively pursue electrification of their fleets; it will be important for Ford’s ability to differentiate and communicate their unique value proposition to customers clearly. In keeping its edge innovative practices that are client-oriented and alliances will be necessary considerations.

13. Conclusion: Ford’s Path Forward in a Changing Automotive Landscape

Ford is making a massive $1.9 billion change in their strategy for electric vehicles, as they try to navigate a constantly changing market. By focusing on producing more compact and inexpensive EVs along with increasing their hybrid range, Ford is aiming to make better gains in terms of profits from EVs thereby improving sustainability.

While this decision incurs huge costs and risks financially, it is a pragmatic way to compete in an automobile industry that is becoming increasingly occupied by the Chinese automakers even as consumer preference changes over time and various regulations take shape. As Ford’s EV plans keep evolving, coming years hold the answer to whether this shift will turn out to be successful or not for the firm or its shareholders.